The problem with central banks' massive bond-buying programs is that if consumers and businesses fail to borrow money to stimulate economic growth, the policy is rendered mostly "useless," one Nomura economist said Friday.

The U.S. and U.K. embarked on asset-purchase, or quantitative easing (QE) programs, following the 2007-2008 global financial crisis. Japan joined the QE club in 2013 and the European Central Bank began its 1 trillion euro ($1.06 trillion) bond-buying stimulus this week.

Read More ECB begins bond-buying: What should you do?

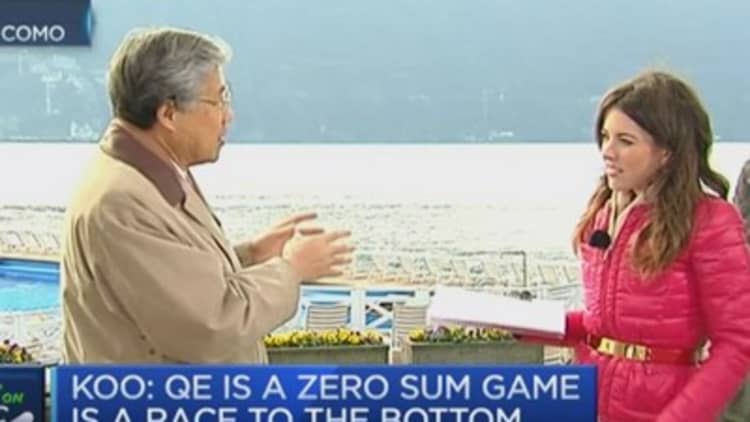

"Both the U.S. and Europe are facing the same problem– which is that we are in a situation where the private sector in any of these economies is not borrowing money at zero interest rates or repairing balance sheets following what happened in the crisis," Richard Koo, Chief Economist at the Nomura Research Institute, told CNBC on the side lines of the Ambrosetti Spring Workshop in Italy.

"When no one is borrowing money, monetary policy is largely useless," he added.

In the run-up to the launch of QE in the euro zone, loans to the private sector, which are a gauge of economic health, contracted. Data published late last month showed that the volume of loans to private firms and households fell by 0.1 percent on year in January, compared with a 0.5 percent drop in December.

According to Koo, major central banks are holding reserves far in excess of levels they need because of the monetary stimulus. This has not led to a rise in private sector spending because big economies are struggling with a balance sheet recession – a situation where companies are focused on paying down debt rather than spending or investing - increasing the risk of QE trap.

"In a national economy if someone is saving money, you need someone to borrow money and this is the part that is missing. They [central banks] are pumping money but no one is borrowing, so you get negative interest rates and all sorts of distortions," Koo said.

He added that instead of looking to raise interest rates, the U.S. Federal Reserve should first focus on reducing its balance sheet which stands at over $4 trillion.

The Fed, which meets next week, is widely expected to raise rates this year against a backdrop of improving economic data.

Read More

"They [Fed policy makers] should not rush into a rate rise; they should reduce the balance sheet when people are not worried about inflation," Koo said.

Follow us on Twitter: @CNBCWorld