U.S. stocks jumped about 1 percent to close near highs on Friday, continuing several days of alternating gains and losses as investors weighed a weaker dollar amid options expirations.

The Dow Jones industrial average and S&P 500 broke three weeks of consecutive losses to post gains of more than 2 percent for the week.

"I can't explain the violence of the rally," said Peter Boockvar, chief market analyst at The Lindsey Group, noting that there was no major news that would move stocks. "The weaker dollar is helping the Dow because of the large multinationals in the Dow."

The U.S. dollar traded below recent highs, posting its first weekly loss in five weeks. The euro held near $1.08 for its first weekly gain in five and the best week since the one ending October 14, 2011.

Crude oil futures broke a four-week losing streak to settle up $1.76 at $45.72 a barrel. Gold futures closed up $15.60 at $1,184.60 an ounce.

"I think the basis of today is the weaker dollar (which is) lifting commodities," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The Dow Jones Industrial Average briefly rose more than 225 points before paring gains to close up 168.62 points, or 0.94 percent, at 18,127.65, with Nike leading gains and Apple and UnitedHealth the greatest laggards. The blue chip index posted gains of 2.13 percent for the week.

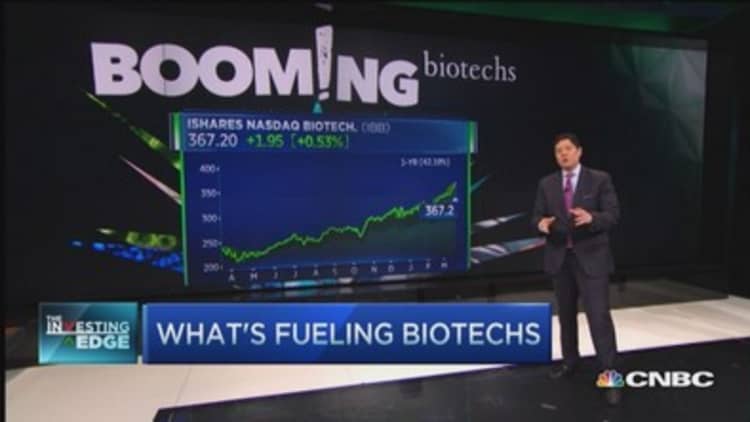

The Nasdaq closed up 34.04 points, at 0.68 percent, at 5,026.42, above the psychologically key level of 5,000 for the second time since the tech bubble in March 2009. The index had its best weekly gain since the week ending October 31 as the index approached its 15-year record closing high of 5,048.62. Biotech stocks and Facebook led gains.

Read MoreThese stocks are insulated from the rising dollar

The closed up 18.79 points, or 0.90 percent, at 2,108.06, just shy of its record close of 2,117.39. Energy led gains across all 10 sectors as the index posted an increase of 2.66 percent for the week.

"If the S&P can hold 2,100 it will be very, very bullish," said JJ Kinahan, chief strategist at TD Ameritrade. He noted that the S&P 500 traded higher this week since it was able to hold above 2,050 last week.

The Russell 2000 extended gains to set a new record for the third day in a row.

Weekly performance of major indices year-to-date

"The day-to-day relationships (with oil, etc.) are mixed up. We're just continuing to ride the idea that Janet Yellen is never going to raise rates and even if she does it's going to be so slow that we're not going to notice," Boockvar said.

The U.S. 10- year Treasury yield held steady near 1.94 percent. The edged lower to 0.58 percent.

The Federal Reserve removed "patient" from its statement on Wednesday but lowered its interest rate outlook and economic forecasts.

Read MoreIs Janet Yellen being too socialist?

Atlanta Federal Reserve President Dennis , Reuters reported.

He expects the U.S.central bank to raise interest rates at either its June, July or September policy meetings, barring a significant downturn in the U.S. economy.

The lower economic forecasts issued by the Fed earlier this week reflect mostly ``transient'' changes that do not fundamentally change its outlook for continued U.S. growth, Lockhart told reporters after a speech at a University of Georgia Law School symposium.

Boockvar said Lockhart has spoken about a June or September rate hike in the past and that the Friday remarks were "nothing new."

Chicago Federal Reserve Bank .

No major economic reports were due.

"Investors are really trying to balance the pace of economic growth, slower than consensus (earnings growth) in the first quarter, lower energy prices and a pretty confident consumer," said Art Hogan, chief market strategist at Wunderlich Securities.

Hogan pointed out that the S&P 500 and Dow Jones industrial average have not had two days of consecutive gains or losses since the middle of February. Friday marks the eighth consecutive trading session in which the two indices have alternated between daily gains and losses, with the Dow moving triple-digits each day.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 13.

Read MoreNew round of volatility may be on way

Analysts attributed the expiration of options to the surge in trade volume.

Four shares advanced for every decliner on the New York Stock Exchange, with an exchange volume of 2.1 billion and a composite volume of 5.1 billion.

High-frequency trading accounted for 47.5 percent of March to date's daily trading volume of about 6.6 billion shares, according to TABB Group. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

European equities closed higher on Friday, with the FTSE 100 above 7,000 for the first time, boosted by strong performance from British energy and basic resources stocks.

Developments in the Greece debt talks also encouraged investors.

Earlier in the day, German Chancellor Angela Merkel said that Greece would present a list of reforms over the next several days. The European Union held the second day of its summit in Brussels.

"It's a little bit of optimism around Greece. It looks like the talks might have gone slightly better. I remain very, very cautious. The market is somewhat illiquid. It's been a very big week," said UBS managing director and FX expert Paul Richards. "… We had a very big move with the Fed."

Read MoreDollar 'success story' good for stocks: McCulley

Simon Property made its "best and final offer" to acquire all outstanding shares of operator Macerich for $95.50 a share in cash and Simon shares, an approximate value of $23.2 billion, including assumption of about $6.4 billion of outstanding Macerich debt, a Simon press release said. Earlier this week, the .

Amazon received approval from the Federal Aviation Administration to test drones in Washington State. The firm could see some headway on the "Prime Air" service it would like to offer.

In other news, Bank of New York Mellon agreed on Thursday to pay $714 million to settle allegations of fraudulent foreign exchange practices.

Read MoreEarly movers: Tiffany, Darden, Simon & more

Nike topped Wall Street's earnings estimates on Thursday after the bell, but sales figures came in below expectations as it struggled with the negative impacts of a stronger dollar

Tiffany reported results before the opening bell, that showed 1 percent drop in quarterly sales, hurt by a stronger dollar and weak demand during the holiday shopping season.

Darden Restaurants reported same store sales rose 3.6 percent in the most recent quarter, and boosted its outlook for the full year.

U.S. stocks mostly sold off on Thursday following a surge on Wednesday on the dovish Federal Reserve statement that indicated a rate hike would come gradually.

As of Thursday's close:

- The Dow Jones industrial average was within one standard deviation above its 50-day moving average. Since 1981 the index has been in this position 6.52 percent of all trading days, according to quantitative analytics tool Kensho. The probability of the index moving lower is 52.2 percent and the probability of it moving higher in the days following is 47.8 percent.

- The S&P 500 was within one standard deviation above its 50-day moving average. Since 1980 the index has been in this position 6.26 percent of all trading days, according to Kensho. The probability of the index moving higher in the days following is 53.4 percent and the probability of it moving lower is 46.6 percent.

- The Nasdaq composite was within 1.5 standard deviations above its 50-day moving average. Since 1980 the index has been in this position 8.27 percent of all trading days, according to Kensho. The probability of the index moving lower is 65.1 percent and the probability of it moving higher is 34.9 percent.

—CNBC.com and Reuters contributed to this report.

Disclosure: CNBC's parent NBCUniversal is a minority investor in Kensho.

More from CNBC.com: