A government jobs report, like the one for March, that's so out of whack compared to expectations usually sparks admonishments from market watchers not to make too much out of any single monthly data set.

But leading labor economist Ed Lazear said Monday that this time is different. "The reason I pay a little bit more attention to this one, it's not just one month, it's a series of indicators—almost all of which—are pointing in the same direction."

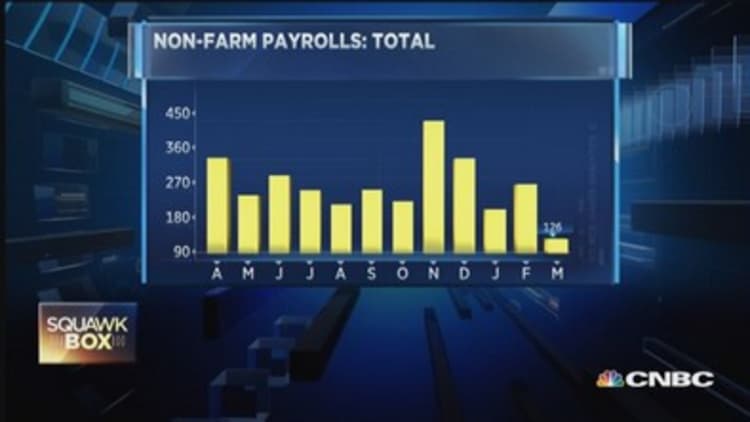

"The trends are down. If we look at the last three months as compared to the previous nine months, that's also negative," he told CNBC's "Squawk Box."

Read MoreThese are 'irrational times' on Wall Street: Darst

When the stock market was closed for the Good Friday holiday, the Labor Department said nonfarm payrolls grew just 126,000 last month, the worst since December 2013. The jobless rate in March remained unchanged at 5.5 percent.

Lazear, chairman of the Council of Economic Advisers under President George W. Bush, said the household survey numbers were not good, with the 8.6 million people out of work holding pretty steady.

Another negative, he cited, was the slight drop in the hours of the average employee's workweek. "The hours decline can give you about 350,000 jobs negative. So that's a big statistic."

"The one positive is, of course, the wage growth that we saw," the Stanford professor said. Average hourly earnings for March were 7 cents higher—representing a year-over-year rise of 2.1 percent. But he warned that this number has been volatile, and should not indicate the kind of inflation the Federal Reserve wants to see before policymakers start increasing interest rates.

As for the health of the overall economy, Lazear said growth is only slightly better than the pre-2008 financial crisis 30-year average. "We're about 15 percent down from the GDP we would have had, had we not had a recession and very slow recovery."