Amid the stock market sell-off, investors have been focused on the Federal Reserve and the fear that there could be too much monetary policy tightening and too many rate hikes.

But Strategas head of policy research Dan Clifton said the investors he talks to have a real fear of potential fiscal policy missteps that could be made by President Donald Trump or Congress.

"While most of the dislocations in financial markets seem non-policy related, there are a number of policy issues which can add further strain at a time of volatile markets. In most cases the probability of these actions is low but worth keeping an eye on," Clifton wrote.

Here are some of the concerns, according to Strategas:

Protectionism

This big worry has been hovering over the market since the president was still a candidate. While there have been only minor trade actions so far, markets have been concerned Trump will kill the North American Free Trade Agreement and start a trade war with China.

"The big question is whether the US will impose tariffs on China for stealing US companies' intellectual property. The risk from NAFTA withdrawal seems to be fading," writes Clifton.

Debt ceiling

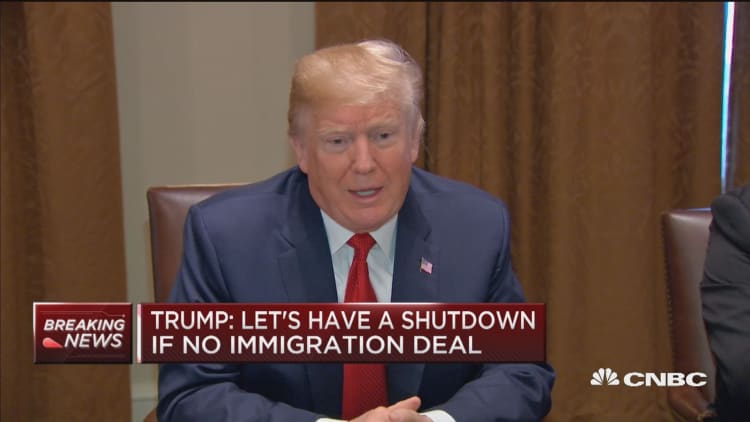

Congress needs to deal with both a short-term funding extension this week and the debt ceiling in the very near future. President Trump Tuesday said he'd "love to see a shutdown" if there's no deal on border safety and immigration in connection with the spending authority vote. Around the same time Trump made the comment, Senate Majority Leader Mitch McConnell and Senate Minority Leader Chuck Schumer sounded an optimistic tone about reaching a spending deal.

Getting a bipartisan deal could be harder after the $1.5 trillion deficit-funded tax cuts. But Clifton predicts the debt ceiling will be lifted even though it will be "the largest DC-based cloud over financial markets through mid-March."

Mueller investigation

Clifton says special counsel Robert Mueller's investigation will likely end soon with a recommendation of obstruction of justice charges against Trump. The fact that the GOP lawmakers are challenging the investigation makes getting bipartisan cooperation more difficult, including on the debt ceiling. Strategas notes Mueller cannot indict Trump, but the special prosecutor's report could be released ahead of midterm congressional elections.

Midterm elections

The years with midterm elections are very volatile for stocks, with the S&P 500 averaging an 18 percent decline. The last three midterm years had smaller, 12 percent sell-offs. Midterm corrections tend to be good buying opportunities with stocks higher one year later by an average 36 percent.

Overheating economy, too much stimulus

Strategas says the talk in Washington is that Congress is readying a $500 billion spending package over the next two years. It will raise defense, nondefense and infrastructure spending, as well as provide funds for hurricane relief and the opioid crisis.

Some investors are concerned the additional spending would be too much fiscal stimulus in the current environment and add to the deficit. The economy is strong, unlike during other major sell-offs, and investors are concerned the tax cut will spark a jump in inflation. Clifton notes a similar period in 2003 when there were tax cuts. Rising yields "should be viewed as a growing pain, not a disease," he added.

Deficit and debt

The markets have been nervous about the increased borrowing required by the government to handle the growing deficit. Clifton said there will be some offsetting factors to this, such as that the government's tax revenue forecasts are currently based on low growth. The market sell-off should also have one positive in that it will generate more capital gains tax revenue. Clifton expects concerns over deficits to continue through April 2019, but ultimately growth should alleviate some of these concerns.

WATCH: Trump says he'd shut down government over immigration