In this day and age, investors and fund managers alike are constantly on the lookout for new and innovative investment opportunities. But what about something that’s been around for a quite some time, just never in the limelight? This week’s “A Fund Affair” takes the spiritual path that leads to Islamic Funds.

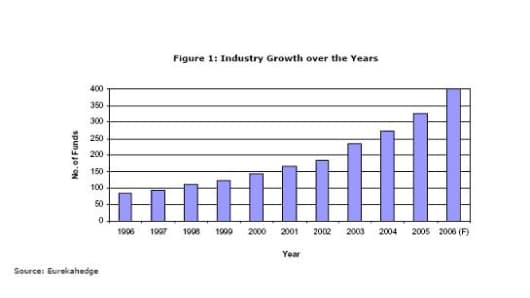

According to figures presented at the 2007 Islamic Funds Asia conference held in March, the Islamic wealth management industry administers assets worth in excess of $750 billion. And the potential of this oftentimes unnoticed and untapped market of investors is growing. With an estimated Muslim population of 1.5 billion worldwide, the Islamic wealth management industry is expected to expand by 10% to 15% in 2007, offering investment options for Muslims as well as the socially responsible investor. This is the full body.