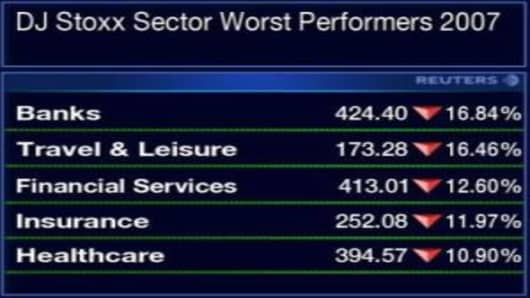

European stocks had a turbulent second half in 2007 and are still in largely in recovery mode as the year draws to an end.

But equities could move higher in the first quarter of 2008, especially if troubled banks signal an end to the credit crunch.

"We're pretty positive about next year. We think it will start slowly, but will get a lot better as we get through the first couple of months," Max King, investment strategist at Investec Asset Management told CNBC.com.

Strong valuations and earnings forecasts, along with supportive bond yields are the positive factors, according to King.