Billionaire to billionaire: Warren, it won't work.

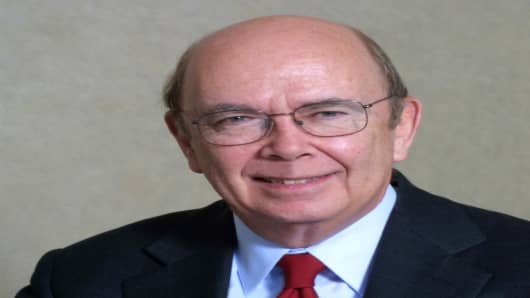

Turnaround specialist Wilbur Ross said Wednesday he does not expect Warren Buffett's offer to reinsure $800 billion of municipal bond debt to succeed.

"If it went through, it would be the best deal since the Dutch bought Manhattan Island from the Indians," Ross said, in an interview on CNBC's "Squawk Box."

"This is the best part of the business for those insurers. It's the safest part. It doesn't do anything to get rid of the toxic waste that they had in the portfolios, both the insurance portfolio and the physical securities."

In all, Buffett's offer covers about a third of the $2.4 trillion of debt guaranteed by the bond insurers.

Still, Ross is glad Buffett advanced his plan because it will put pressure on regulators and others to find another solution for the troubled industry.

"I think the municipal bond holders need a solution," he said.