China's securities regulator, in a fresh effort to prevent a stock market crash, warned companies against making big issues of new shares that could push down the market.

"Refinancing by listed companies is a function of the capital market, and it is an important way for the market to allocate capital in the best way," a spokesman for the China Securities Regulatory Commission said. "But companies should on no account maliciously seize money from the market," said the spokesman, quoted by the official Xinhua news agency on its Web site.

In a commentary, Xinhua itself warned that excessive share issues could cause the market to collapse. "Listed companies should not regard the stock market as an automatic teller machine from which you can withdraw as much cash as you like. If the market crashes, everybody in the market will be a loser," Xinhua said.

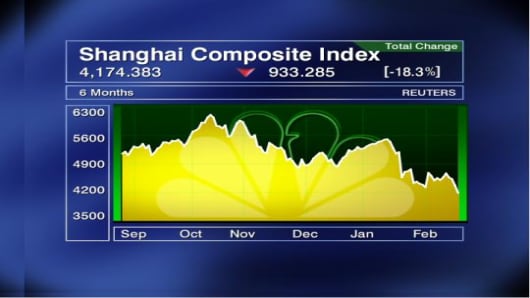

The warnings reflect how alarmed Chinese authorities are over the sagging stock market. The Shanghai Composite Index is now down 18 percent year-to-date and 32 percent below the record high set last October.

In February, the index plunged because of concern about the market's ability to absorb big supplies of new shares, including huge offers planned by Ping An Insurance and Shanghai Pudong Development Bank.

The effect of this statement was almost immediate with Ping An issuing a statement Tuesday. "Our company has noticed the comments made by the spokesman of the China Securities Regulatory Commission ... The company will prudently consider the timing and size of the fund raising as well as market situation," a Ping An spokesman was quoted by the Shanghai Securities News.

Ping An had intended to raise as much as 120 billion yuan (US$16.8 billion) by issuing new shares and convertible bonds, in what could be one of the world's largest equity refinancings. China's second biggest life insurer has said it needs the money to boost its capital and make unspecified investments at home and abroad.

But now, Ping An is indicating that it might postpone or scale back the massive share issue, sending its shares sharply higher Tuesday. Ping An stock has plummeted the past month due to concern that the market wouldn't be able to absorb such a large offer.

Fund managers said the commission's warning might help the stock market rebound in coming days by suggesting authorities were determined to prevent a collapse of share prices.

"This is a clear signal to other firms which may want to raise money. Now they may not dare announce those plans, at least for now," said a fund manager at a Sino-European joint venture, who declined to be identified because he had not yet made a decision on how he would vote at Ping An's shareholder meeting.

But he and other fund managers said it was not clear whether even a halt to new fund-raisings would be enough to trigger a sustained rally by the market.

Investors are also worried by huge amounts of new shares that will become freely tradable this year as lock-up periods related to initial public offers and reform of companies' state shareholding structures expire.

The official China Securities Journal estimated last week that 401 billion yuan of such shares would become tradable in March. The market is also worried by rising Chinese inflation, at an 11-year high, and by the threat of a U.S. economic recession.

Over the past month, the commission has tried to support the market by approving the creation of three batches of new investment funds, lifting an informal suspension of such approvals that had been in effect since September. But this intervention has had little impact, and the index sank 4.07 percent on Monday to a seven-month closing low.

The commission's warning apparently did not apply to IPOs by big Chinese companies. On Tuesday China Railway Construction is due to accept retail subscriptions for the Shanghai portion of a dual IPO in Shanghai and Hong Kong that could raise a total of $5.4 billion, making it the world's largest IPO so far this year.

But the Shanghai portion of the IPO was delayed for several weeks because the regulator was concerned about its impact on the market, according to people with knowledge of the plan, and the size of the Shanghai tranche was cut by more than 10 percent.