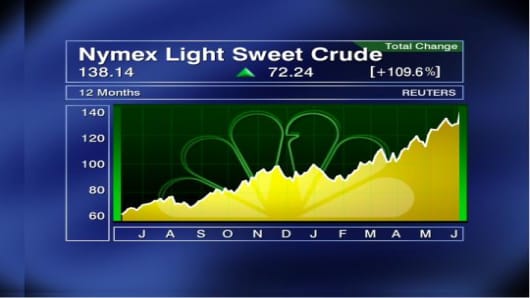

It was a black Friday for markets in the U.S. with the Dow losing more than 3 percent as crude oil hit a new all-time high of $139.12 during the session. Oil settled Friday at $138.14 a barrel, climbing $11.19 for the week -- its biggest weekly gain on record -- and up a whopping 43 percent since the start of the year.

All this as oil executives gather in Kuala Lumpur this Monday and Tuesday for an Asian energy summit, with question marks hanging over the outlook for regional demand but more importantly, why this huge run-up in prices?

Earlier in the week - at face value at least - it seemed the bearish players in the market had the upper hand. All the stars seemed in alignment for a convincing reversal: U.S. data gave more evidence of demand erosion, Asian demand looked like it could weaken in the wake of price hikes, the CFTC probe into speculation could hit activity plus the dollar appeared on a firmer footing after Bernanke's warning on inflation.

Then the oil market roared back Friday confounding many experts and seasoned traders. Is it speculation, the weaker dollar or pure supply and demand fundamentals that are driving prices higher? The Asian Oil & Gas Conference will be a timely opportunity for us to put these questions to industry leaders.

Asian consumers have been shielded to a large extent from soaring crude oil prices by government subsidies. But all that's changing.

India and Malaysia joined a growing list of countries slashing subsidies and raising fuel prices. Escalating global oil prices mean governments can ill-afford to sustain ballooning subsidies. That’s led policymakers to bite the bullet and raise fuel prices. We’re now witnessing the fallout of these policy actions - widespread public protest and anger about the higher cost of living.

It's not just oil prices that are surging. The price of equally important essentials such as cooking oil, rice, wheat, soybeans and pork are spiraling too. This is making inflation busting doubly challenging for policymakers. In short, Asia is getting sucker-punched from cost pressures on multiple fronts.

The prospect of skyrocketing fuel prices has raised fears of a slowdown in Asian oil demand. Demand erosion figured as a major theme this week as U.S. data showed a 1.4 percent decline in gasoline demand over the past weeks. Clearly, U.S. consumers are flinching at $4 a gallon gasoline, which is the proverbial sticker price shock in many U.S. states.

The Asian demand story -- with China and India the twin engines of growth -- has been a central pillar of support holding up the secular bull market for oil. If that goes, all bets are off. "Potential demand destruction is huge," Tom Weber, senior market strategist at Axis Global management told me this week. "But it’s still early in the game. Many emerging markets still subsidize fuel to a high extent."

Alaron Trading's Phil Flynn writing in his insightful and inimitable daily energy report this past Wednesday also raised the question of whether the almighty Asian demand, such a key driver for the bull case, may start easing off. He asks: "Is it possible that we can question the bullish dogma that the majority of the world would continue to consume more and more oil regardless of price?"

The bottom line is that it's too early to predict whether this latest round of fuel price hikes will damp demand. The market reacted bearishly. The news contributed to a more than $2 a barrel decline on Wednesday though prices bounced back aggressively on Friday, surging over $10 -- the biggest one-day increase in dollar terms in its Nymex history.

Such striking shifts in sentiment in the space of a week. Still, the seed of the idea of ailing Asian demand brought by higher prices has been planted in the market psychology. "Throughout Asia subsidies are being lifted and in an inflation plagued India this increase could have a significant impact on demand," Flynn said of India's latest fuel increases.

India constitutes roughly 3 percent of global crude consumption, compared to 25 percent in the U.S. and 9 percent in China. The question now remains given the roll-call of Asian nations which have taken the politically unpopular step of raising fuel prices, will China follow and if it does so, what will be the impact on global demand stemming from possible demand destruction? Given already surging inflation and the aftermath of the devastating earthquake in Sichuan, policymakers in Beijing will fight tooth and nail to resist withdrawing subsidies and implementing fuel price increases.

The authorities are unlikely to unveil new tightening measures or raise fuel prices in the short term following the devastating earthquake on May 12 and in the face of high inflation, China’s Xinhua news agency reported this week, citing Chinese investment bank China International Capital Corp. The decelerating inflation might offer an opportunity to raise fuel prices in the second half of the year, the report said.

Markets will be watching China's actions closely, post-Olympics. In the meantime, policymakers will continue to watch how oil prices evolve. A sustained retreat towards $100, possibly lower, will be a huge benefit, taking the heat of governments to push through further price increases.

These are supremely challenging times for the industry and Asian leaders. More so than ever-before, the audience and the broader market will want to hear what executives from Asian state-owned oil companies attending the summit have to say about which way the wind is blowing for prices.

Send Sri your questions and comments at commoditystore@cnbc.com.