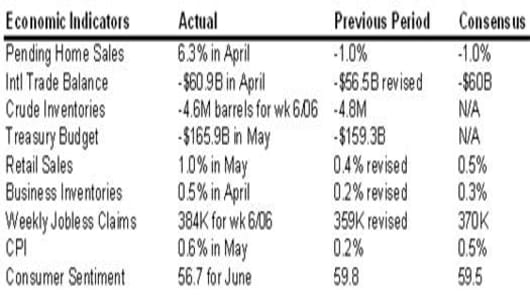

For the week ending Friday, June 13, 2008, the markets were mixed on varied economic news, renewed credit concerns from Lehman and the financial sector, and of course, oil. A surprise increase in retail sales gave hope for economic growth and a rising CPI suggested a potential rate move on the horizon that could strengthen the dollar and begin to tame inflation.

Next week, the markets will focus on a big batch of earnings from big names in the investment banking community, including Lehman Brothers, Morgan Stanley, and Goldman Sachs. Other market impacting events to look for are Housing Starts, Industrial Production, and PPI data.

Highlights:

M&A, Deals, Corp Actions:

- Anheuser-Busch received an unsolicited offer of $47 billion from rival Belgian brewer, InBev as the merger would create a global beer-hemoth. Shares of BUD advanced 6.7% for the week.

- Microsoft ended takeover talks with Yahoo as Yahoo partnered with Google to outsource some of advertising. Yahoo shed 10.06% on Thursday on deal termination, while Microsoft managed to finish up 4.13%.

- Invitrogen entered a merger agreement with Applied Biosystems Group for $6.7 billion, in an effort to combine research and development capabilities. Shares of ABI moved up 5.3% on Thursday on the news.

- Nortel and Alvarion entered into a joint agreement for WiMax in order to serve its customers worldwide with faster wireless technology. Shares of both, Nortel and Alvarion climbed 31.2% and 4.5% respectively for the week.

- XTO Energy announced the acquisition of privately held oil and natural gas producer, Hunt Petroleum for $4.2 billion with the objective of increasing natural gas production. XTO shares jumped 3.5% for the week.

- BE Aerospace Inc. agreed it would buy Honeywell’s consumables solutions business for $1.05 billion, allowing Honeywell to focus on more sophisticated technologies, while BEAV would widen its direct sales. Shares of BEAV closed up 11.04% on Monday after the merger news.

- Pier 1 Imports proposed to acquire Cost Plus , a smaller furnishing rival for $88 million in an attempt to create a more competitive company. Shares of Pier 1 dropped 16.8% while Cost Plus stock advanced 9.5% for the week.

Other Market Moving News:

- Lehman Brothers forecast a second quarter loss of $2.8 billion and plans to sell $6 billion in stock to raise capital. The company also reported the replacement of its Chief Operating Officer and Chief Financial Officer. Lehman shares are down more than 60.6% year to date and have fallen 20% for the week on continued liquidity concerns.

**Other financial companies such as Goldman Sachs, Merrill Lynch, Morgan Stanley, and Washington Mutual were amongst some of the financials pushing the S&P financial sector to negative territory as it finished down 0.6% for the week. Financial companies are expected to report earnings next week, and Lehman may have helped stoke renewed credit crunch fears. - Citigroup announced the shut down of its Old Lane Hedge Fund after continued losses from alternative investment assets. Citigroup will take in about $9 billion in assets after the closing of the unit. Citigroup’s shares advanced 3.54% on Thursday after the announcement.