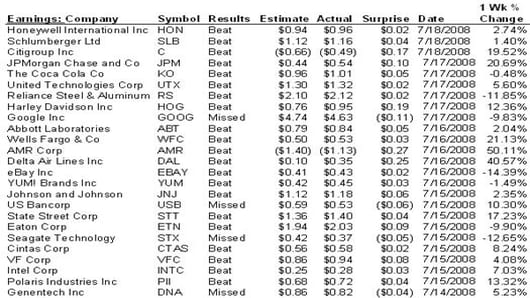

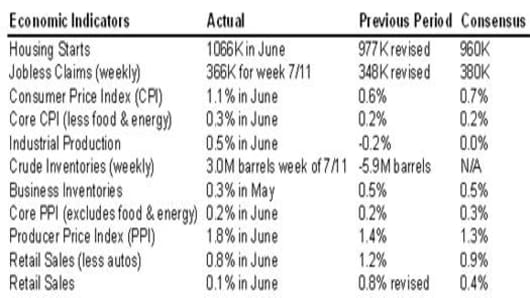

For the week ending Friday, July 18, 2008, the U.S. markets saw extreme volatility yet settled higher on better-than-expected earnings results, a pullback in crude oil, and an indication that the Fed will hold interest rates steady. The CBOE Volatility Index (VIX) surpassed the 30 mark on 7/15 during intraday trading, its highest level since late March. Nonetheless, the Dow had its best week since April 18 and biggest 3-day percent gain since March 2003, even after closing below 11,000 for the first time since July 2006. It pared its losses on Wednesday by closing up 276.7 points, its largest gain since 4/1. Financials rallied over 20% from their lows while oil fell over 11% for the week from its high.

Next week: The markets will be watching for a heavy concentration of earning reports giants such as: Bank of America, Schering Plough, Merck, Apple, Texas Instruments, DuPont, Wachovia, Yahoo, Pfizer, GlaxoSmithKline, AT&T, McDonald’s, Wyeth, Amazon, and Philip Morris. It will be a relatively quiet week for economic data, with data on Durable Goods Orders, Consumer Sentiment, Existing and New Home Sales.

Highlights:

M&A, Deals, Corp Actions:

Barr Pharmaceuticals and Israel’s generic-drug maker Teva Pharmaceuticals gained 45.48% and 2.61%, respectively for the week on Teva's $7.46 billionacquisition. The deal would create greater distribution channels for both firms, with Teva strengthening its position in the U.S. markets.

Cleveland-Cliffs agreed to buy coal miner Alpha Natural Resources for $10 billion, as the company seeks further diversification in steelmaking. However, Cleveland’s large shareholder, Harbinger Capital, objected to the company’s proposed takeover deal. The consolidation of both firms would create one of the biggest U.S. mining companies. CLF’s shares reacted negatively to the acquisition, dropping 10.22% for the week.

Waste Management Inc announced a buyout bid on Monday of rival firm Republic Services for $6.3 billion in an effort to dampen Republic’s own prior acquisition offer of number 2 waste management firm Allied Waste . Consequently, Republic Services rejected Waste Management’s takeover bid, deeming Allied Waste as a more favorable acquisition, initially valued at $6.24 billion. Republic’s shares surged 16.31% for the week, while Waste Management’s bittersweet proposal led its stock to a 3% decline.

Other Market Moving News:

- American Airlines publicized that it will lay off 1,300 mechanics as well as 200 additional workers. Airlines such as American have been restructuring and trying new ways to offset growing fuel costs, from charging for additional check-in bags to flying with less fuel.

**American Airlines also reported a robust 2Q net loss of $5.77/share, while Delta’s (DAL) earnings came in slightly better at a 2Q net loss of $2.64/share.

***A brighter week for airlines as major airlines such as UAL Corp, American Airlines, Delta, and Northwest shares rallied 50.14%, 50.11%, 40.57%, & 40.79% amidst a fall in crude prices. - General Motors announced a plan to raise $15 billion by cutting worker costs, lowering capital spending, and through future asset sales. GM traded up 32.86% for the week.

- Banks such as Washington Mutual , National City , First Horizon National Zions Bancorp faced heavy sell-offs on Monday after the Federal Deposit Insurance Corp. (FDIC) seized the California savings bank, IndyMac Bancorp (IMB), marking the fifth bank to fail as a result of the U.S. subprime mortgage crisis. Shares of all, WM, NCC, FHN, ZION plummeted 34.7%, 14.71%, 24.78%, 23.2%, respectively Monday led by bank failure speculations and risky mortgage-loans exposure & downgrades.