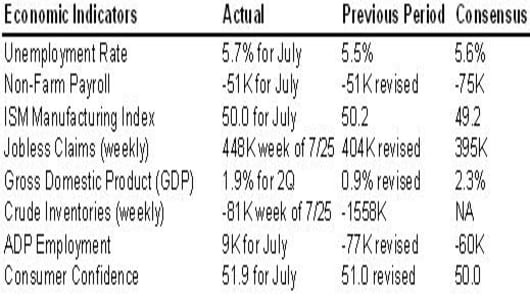

For the week ending Friday, August 1, 2008, the markets finished relatively flat after a turbulent week that saw 4 straight days of triple-digit moves on the Dow. An early rally was dampened by weak economic data including weaker-than-expected GDP and a rise in the unemployment rate. The Dow & Nasdaq Composite had 2-day gains of more than 450 points and 65 points, respectively on Tuesday and Wednesday before giving it back on Thursday and Friday. The current economic data supports the view that the Fed may hold interest rates steady at next week’s meeting.

Highlights: The markets will watch for major economic data including Personal Income and Outlays on Monday and a rate decision from the Fed on Tuesday. Earnings reports will include from Procter & Gamble, Freddie Mac, Time Warner, Cisco, AIG, and Berkshire Hathaway. Also, look to the opening of the Olympics Games which begins on Friday.

M&A, Deals, Corp Actions:

Bristol-Myers Squibb proposed a full acquisition of Imclone Systems for $4.5 billion, that would give the company greater ownership of the cancer drug Erbitux, becoming the second pharmaceutical company to buy its biotech partner in over a week. The offer comes after last week’s offer from Swiss drug maker Roche to buyout U.S. biotech Genentech . Shares of Imclone Systems gained 41% for the week on merger news.

China Distance Education, an online educational provider in China, had its IPO on the NYSE with an initial public offering of $7/share. Shares experienced a 5% drop on Wednesday. China Distant Education is the second Chinese company to go public in the US this year, followed by ATA Inc. in January. ATAI is up more than 57% from its initial price of $9.50/share.

Unilever N.V.'s ADR fell nearly 8% for the week on flat volume growth. This was after the consumer discretionary company publicized the sale of its North American laundry detergents unit, including brands like All, Snuggle, and Wisk, for ~$1.1 billion in cash to private equity firm Vestar Capital Partners. The company expects the sale to reduce costs related to market share loss and allow it to launch new products.

Sempra Energy announced plans to acquire EnergySouth for $510 million with the objective of extending its natural-gas business strategy. Shares of ENSI settled up 18.8% on Monday on merger news.

Other Market Moving News:

Shares of Elan Corp. and Wyeth plunged 70.5% and 11.5% for the week on safety issues with their clinical results for their Alzheimer’s drug, Bapineuzumab.

Ford , General Motors , and ChryslerLLC announced scale backs of their auto leasing businesses. On Tuesday, Ford announced to dealers, that the company is ending lease contracts on most trucks and sports utility vehicles (SUV’s). GMAC LLC, GM’s financing arm also stated that the company is terminating subsidized leases in Canada, and Chrysler last week said is ending all lease offers in the U.S.

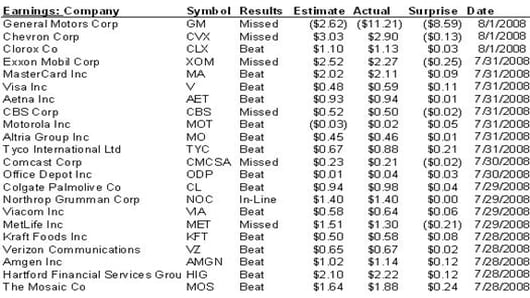

** GM announced a loss of $6.3 billion, more than four times worse than analysts expected. With charges, the loss was more than $15 billion.

**Automakers are incurring bigger losses due to the declining re-sale value in these types of gasoline-guzzling leased vehicles. Shares of F and GM have been struggling year to date, as they are both down, 31% and 59%, respectively.Financials stocks rebounded this week leading the other S&P 500 Sectors, up nearly 4%. The news wasn't perfect for all companies, as Merrill Lynch, Fannie Mae , and Freddie Mac tested their lowest levels on Monday, each falling more than 7% after the International Monetary Fund (IMF) warned of increased risk due to ongoing financial crisis, and pressed for the U.S. Government to evaluate the business model of these firms. MER and FRE finished the week down 2.4% and 3.5% while FNM gained 2.3%.