Last April, Michael Lewis wrote an article about the possibility of one day trading shares of professional athletes . The idea was to actually own a piece of that athlete and to trade shares in that athlete.

The primary reason this wasn't going to work was because people would mostly want to trade and get a piece of athletes who were already too far along for an investment to make sense. Why would Tiger sell any piece of himself when he is already so valuable? Why, for that matter, would even a No. 1 draft pick sell a piece of himself?

Then Randy Newsom came along. The Cleveland Indians minor leaguer announced he was selling shares in himself, formed a company called Real Sports Investments and came on CNBC to talk about it . But after talking with Major League Baseball, the plan fizzled.

I decided that if a sports stock market was to make it with real money, it would have to be something like Protrade. For years, Protrade allowed fans to trade virtual shares of players for fake money.

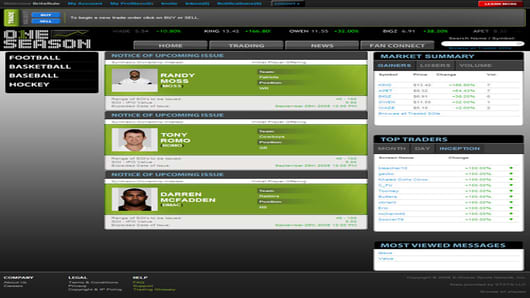

A new site launched yesterday called OneSeason.com. It's basically trading virtual shares of players for real dollars.