Wall Street went on a bargain-hunting bonanza, with a frenzy of activity in the final hour of trading that sent shares up 11 percent.

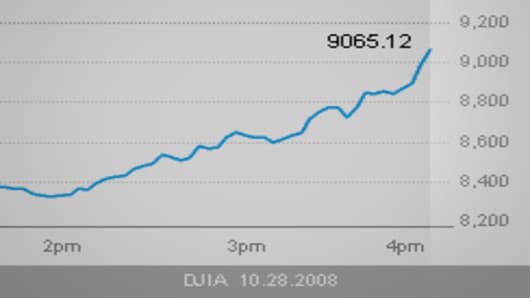

The Dow Jones Industrial Average finished up 889.35, or 11 percent, to close at 9065.12. It was the second-biggest point gain on record and the seventh-largest percentage gain.

Of course, it wasn't a straight shot: The Dow jumped more than 200 points in the first minute of trading, then bumped that up to about 300, before a dismal consumer-confidence report erased all of those gains. Bargain hunting picked up steam in the final two hours of trading, sending the Dow rocketing to its 11-percent finish.

The S&P 500 jumped 91.57, or 11 percent, to close at 940.49.

The most encouraging thing was that it was "a very broad-based rally," Gordon Charlop, of Rosenblatt Securities, told CNBC. "Everybody’s joining the party, if you will."

Indeed, the gains were across-the-board: All 10 key S&P sector indexes advanced, led by consumer-discretionary, telecom and retail, which all logged gains above 13 percent. Health care posted the lowest gain at 7.5 percent.

The tech-heavy Nasdaq, which has lagged its broader counterparts, advanced 143.57, or 9.5 percent, to close at 1649.47.

Attempting to thwart the market's early attempt at a rally, the Conference Board reported its gauge of consumer confidence plunged to a record low of 38 in October from an upwardly revised 61.4 in September. The October reading fell short of the consensus estimate of 52 and even the most pessimistic forecast in the survey, which was 45.

Obviously, a sharp drop in consumer confidence comes as no surprise at a time like this but the severity of the drop was unexpected and rattled the market.

Asian markets posted solid gains -- Japan led the way with a 6 percent jump. European markets also gained; Germany's DAX was the standout, soaring 11 percent driven by component Volkswagen after Porsche took a larger stake in the company. Earlier this month, a Barron's article seemed to encourage shorting Volkswagen as the stock was likely to go down when Porsche's stake got over 50 percent.

VW shares, which have quadrupled since Friday's close, added another 80 percent in the current session, briefly making VW the largest company by market cap, eclipsing ExxonMobil.

The stock's surge triggered a short squeeze, and the buzz was that Morgan Stanley and Goldman Sachs were caught on the wrong side of the squeeze. Those stocks took a beating in intraday trading but later joined in the rally, ending up 11 percent and 0.7 percent, respectively.

A Morgan Stanley spokesman told Reuters the company doesn't have any exposure to Volkswagen, though that doesn't necessarily mean the firm doesn't have a short position against the stock. Goldman declined to comment but sources inside the firm told CNBC Goldman had no significant losses tied to Volkswagen.

Dow component General Motors , which led the blue-chip index lower Monday, was one of the index's biggest gainers Tuesday as the auto maker, along with Cerberus Capital Management, is asking the government for $10 billion to facilitate a GM/Chrysler merger, according to Reuters.

GM shares shot up 15 percent, while rival Ford gained 5.9 percent.

All 30 Dow components ended higher, with Alcoa leading the pack at 19 percent and 3M riding in the caboose with a 6.5-percent gain.

Boeing shot up 16 percent after the aerospace giant reached a tentative labor agreement with its biggest union.

Verizon gained 15 percent after the telecom beat earnings expectations, helped by strong sales.

A fun little bit of market trivia: Over the past 80 years, Oct. 28 (today) has, on average, marked the trough in the year for the S&P 500, according to Deutsche Bank.

September and October are typically weak (check! we've got that). So, "From a seasonality perspective, one could argue that the end of October could be an entry point," Bernd Meyer, head of pan-European equity strategy at Deutsche Bank in London, told Reuters.

American depositary shares of BP soared 16 percent after the British oil company said its profit more than doubled, helpedbysoaring oil prices.

U.S. oil giant ExxonMobil jumped 13 percent afterfalling more than 4 percent Monday.

Crude fell 49 cents to settle at $62.73 a barrel.

In tech land, shares of Cisco advanced 14 percent after Goldman Sachs added the stock to its recommend list.

ADRs of German software maker SAP eked out a gain of 6 percent, after an earlier decline as the company scrapped its 2008 revenue outlookdue the uncertainty in the global economy.

This Week:

TUESDAY: Fed begins two-day meeting

WEDNESDAY: Weekly mortgage applications; durable goods; weekly crude inventories; Fed announcement on interest rates; Earnings from Aetna, Corning, Kellogg, Kraft, P&G, Qwest, Sony and Visa

THURSDAY: Weekly jobless claims; First look at Q3 GDP; weekly natural-gas inventories; Eanrings from AstraZeneca, Colgate Palmolive, CVS/Caremark, ExxonMobil, Motorola, Royal Dutch Shell and Electronic Arts

FRIDAY: Personal income and spending; consumer sentiment; Fed's Yellen speaks; Earnings from Chevron, Clorox and Nissan

Send comments to cindy.perman@nbcuni.com.