The euro rallied versus the US dollar on Tuesday following the Federal Reserve decision to set its target for overnight interest rates between zero to 0.25%.

The euro hit an intraday high of $1.4097 versus the dollar following the Fed's decision, trading at its highest level since October 1st. The euro also strengthened against the pound sterling, reaching a new intraday-record high of 0.9053 pence per euro.

The european currency gained on interest rates spreads between the United States and the euro zone. Comments from ECB board member Juergen Stark last week suggested that the ECB may not have much room to further lower interest rates. Month-to-date, the euro has appreciated about 10.5% against the US dollar.

Lower risk aversion among investors in the past few weeks has also given a boost to the european currency. The VIX , for example, has retreated from an all-time high of 89.53 on October 24.

The surprise move by the Federal Reserve to lower its target for the federal fund rate to its lowest level on record dating to 1954, pushed the greenback lower versus most major currencies.

Against the yen, the US dollar traded below the 90-yen mark, while the pound sterling hit an intraday high of $1.5508 versus the greenback.

The dollar index , which tracks the greenback’s standing against a basket of currencies, hit an intraday low of 80.57, its lowest level since October 14th. Year-to-date, the dollar index is now up 5.27%, after falling 6.69% in the past month.

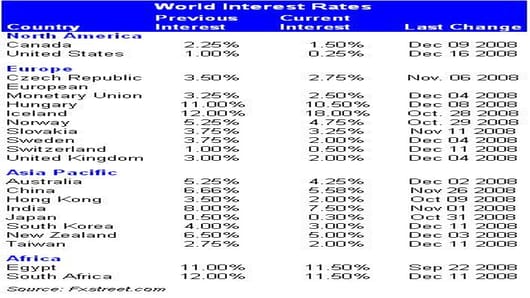

Here is a look at where some of the world’s interest rates stand:

Click here for currencies rates

bythenumbers.cnbc.com