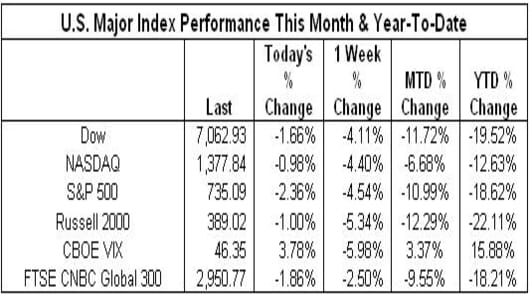

On a week that saw the US economy contract more than expected, the government boost its equity stake in Citigroup, GE cut its dividend, and President Obama present his budget, the markets fell through May 1997 lows, ending the week down 4% or greater.

*The Dow & S&P turn in their worst February performances since 1933 when the Dow lost 15.62% and the S&P lost 18.44%

**The Dow turns in its biggest February point drop since its inception in 1896, losing 937.93 points for the month

*The NASDAQ turns in its worst February performance since 2002 when the NASDAQ lost 10.47%

*On a positive note, the Dow, S&P and NASDAQ tend to have a positive performance in March 60% of the time.

Index Impact:

-IBM (IBM) had the most positive impact on the Dow, up almost 4% for the week.

**YTD, the top Dow performer by % gain remains IBM up over 9% YTD, ALL other Dow components remain negative YTD

*Note in February MTD, Wal-Mart (WMT) and IBM are both positive

-Boeing (BA) had the most negative impact on the Dow, down almost 13.5% for the week

**YTD, Citigroup (C) continues to be the worst Dow performer by % loss, down almost 78% YTD

-JPMorgan (JPM) had the most positive impact on the S&P 500, up over 15% for the week.

**YTD, the top S&P performer by % gain remains Sprint Nextel (S), up almost 80% YTD

-Exxon (XOM) had the most negative impact on the S&P 500, down almost 5% for the week.

**YTD, the bottom S&P performer by % gain is Huntington Bancshares (HBAN) down almost 81% YTD

-Yahoo (YHOO) had the most positive impact on the NASDAQ 100, up almost 9% for the week.

**YTD, the top NASDAQ 100 performer by % gain is Amazon.com (AMZN), up over 26% YTD

-Microsoft (MSFT) had the most negative impact on the NASDAQ 100, down over 10% for the week.

**YTD, the worst NASDAQ 100 performer by % loss is Wynn Resorts (WYNN), down over 50% YTD