BEHIND THE MONEY: Blame Obama For Breaking Stock Market Lows

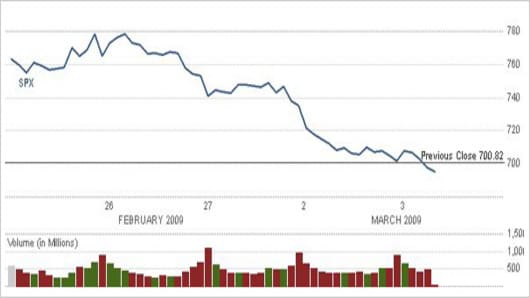

Blame the ongoing credit crisis for the S&P 500's return back to Bear-Market lows, but did President Obama's budget break the market's back and push us through key support levels? With the S&P 500 today now plumbing lows not seen since 1996, many investors and traders are screaming, "Yes!"

"The release of major proposals, such as taxing U.S. multinational foreign earnings, a complicated two-step reduction of itemized deductions, and a major healthcare program, without any explanation, have added to an already uncertain environment," writes Daniel Clifton, head of policy research at Strategas Research Partners, in a note to clients yesterday. "Although the budget holds off on most tax increases until '11, the new permanent level of higher spending (even excluding the new proposals) will require larger tax increases than are being put forth and faster than being proposed."

FM host Dylan Ratigan points out that investors he's spoken with are worried that this massive budget -- either because of higher taxes or because of the potentially tremendous increase in the deficit -- will have the effect of lowering the rate of return for investors over the long-term. Therefore, they are applying an even lower P/E multiple to stocks. The higher taxes in the budget acts to further disincentivize people who take risks in order to make money and grow the economy, notes Tim Seymour, FM trader and managing partner at Seygem Asset Management.

We asked our viewers last Thursday about the budget and 70 percent of you said it would raise taxes at the absolute worst time for this economy. Going by the subsequent market action, viewers put their money where their mouth is and sold stocks.