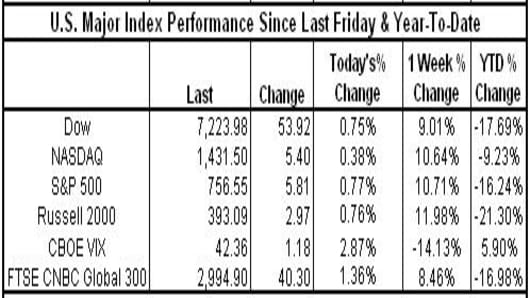

The markets staged the first simultaneous 4-day rally for the Dow, S&P and NASDAQ since May 2007. Financials fueled the rally that saw almost all major US indexes score double-digit weekly gains led by the Russell 2000 rising almost 12% for the week. The G20 debates the need for further fiscal stimulus and oil sees turbulent trading in anticipation of OPEC's meeting Sunday.

*All 30 Dow components were positive for the week

*All S&P 500 components were positive for the week except for 23, led by Pall (PLL) which lost 11% this week, McKesson (MCK) down almost 9% for the week, and National Semi (NSM), down over 8% for the week.

*All NASDAQ 100 components were positive for the week except for 3, Steel Dynamics (STLD), Activation Blizzard (ATVI) and Focus Media (FMCN).

Index Impact:

-JPMorgan (JPM) had the most positive impact on the Dow, up over 49% for the week

**YTD, IBM is no longer the only positive Dow component for the year, up over 7% YTD, Intel (INTC) joins the party turning positive for the year, up 0.27% YTD

-McDonald's (MCD) had the least positive impact on the Dow up 0.50% for the week

**YTD, Citigroup (C) continues to be the worst Dow performer by % loss, down over 73% YTD

-NVIDIA (NVDA) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 17% for the week.

**YTD, the top S&P performer by % gain remains Sprint Nextel (S), up over 126% YTD

**YTD, the top NASDAQ 100 performer by % gain continues to be Ilumina (ILMN), up over 37% YTD

-Exelon (EXC) had the most negative impact on the S&P 500, down about 6% for the week.

**YTD, the bottom S&P performer by % loss continues to be Huntington Bancshares (HBAN) down almost 80% YTD

-Activision Blizzard (ATVI) had the most negative impact on the NASDAQ 100, down over 4% for the week.

**YTD, the worst NASDAQ 100 performer by % loss continues to be Wynn Resorts (WYNN), down almost 51% YTD

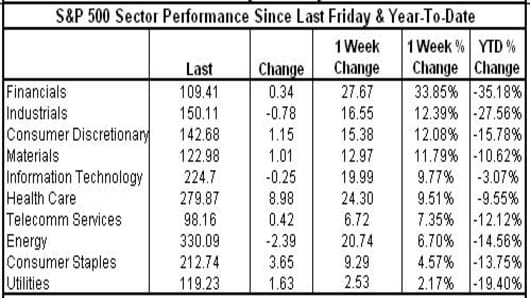

Sector Impact:

10 out of 10 S&P sectors were positive for the week led by Financials up almost 34% for the week. Utilities were the least positive, up over 2% for the week.

*YTD all 10 sectors are negative led by Financials down over 35% YTD. Information Technology is the least negative sector down about 3% YTD

Financials were buoyed by Hartford Financial (HIG), up over 94% for the week

Utilities were helped by AES Corp. (AES), up over 20% for the week, but hurt by Exelon (EXC) down almost 6% for the week.

The markets staged the first simultaneous 4-day rally for the Dow, S&P and NASDAQ since May 2007. Financials fueled the rally that saw almost all major US indexes score double-digit weekly gains led by the Russell 2000 rising almost 12% for the week. The G20 debates the need for further fiscal stimulus and oil sees turbulent trading in anticipation of OPEC's meeting Sunday.

*All 30 Dow components were positive for the week

*All S&P 500 components were positive for the week except for 23, led by Pall (PLL) which lost 11% this week, McKesson (MCK) down almost 9% for the week, and National Semi (NSM), down over 8% for the week.

*All NASDAQ 100 components were positive for the week except for 3, Steel Dynamics (STLD), Activation Blizzard (ATVI) and Focus Media (FMCN).

Index Impact:

-JPMorgan (JPM) had the most positive impact on the Dow, up over 49% for the week

**YTD, IBM is no longer the only positive Dow component for the year, up over 7% YTD, Intel (INTC) joins the party turning positive for the year, up 0.27% YTD

-McDonald's (MCD) had the least positive impact on the Dow up 0.50% for the week

**YTD, Citigroup (C) continues to be the worst Dow performer by % loss, down over 73% YTD

-NVIDIA (NVDA) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 17% for the week.

**YTD, the top S&P performer by % gain remains Sprint Nextel (S), up over 126% YTD

**YTD, the top NASDAQ 100 performer by % gain continues to be Ilumina (ILMN), up over 37% YTD

-Exelon (EXC) had the most negative impact on the S&P 500, down about 6% for the week.

**YTD, the bottom S&P performer by % loss continues to be Huntington Bancshares (HBAN) down almost 80% YTD

-Activision Blizzard (ATVI) had the most negative impact on the NASDAQ 100, down over 4% for the week.

**YTD, the worst NASDAQ 100 performer by % loss continues to be Wynn Resorts (WYNN), down almost 51% YTD

More Weekly Stats Here

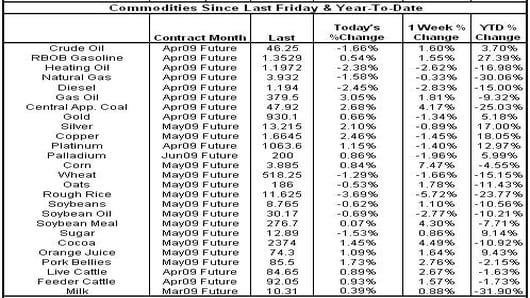

Commodity Impact:

Oil settled at $46.25 per barrel in an erratic session Friday on expectations that OPEC may cut output targets at Sunday's meeting in Vienna, and lower 2009 consumption forecasts by the International Energy Agency (IEA).

Gas Prices: The AAA current national average for regular gas is $1.922 per gallon down 41.17% from a year ago when the average was $3.267 per gallon

-The highest recorded average price by AAA was on 7/17/2008, when the national average was $4.114 per gallon

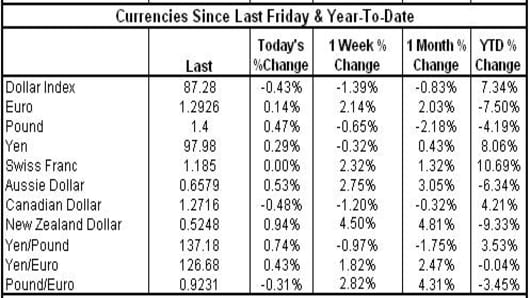

Currency Impact:

The US $ is mixed this week against major currencies gaining against the pound sterling, but losing against the euro and yen for the week. The Swiss franc loses ground against most currencies after the Swiss National Bank intervened in foreign exchange Thursday to weaken the Swiss currency by selling the franc and buying dollars and euros to combat the Swiss recession.

Commodity Impact:

Oil settled at $46.25 per barrel in an erratic session Friday on expectations that OPEC may cut output targets at Sunday's meeting in Vienna, and lower 2009 consumption forecasts by the International Energy Agency (IEA).

Gas Prices: The AAA current national average for regular gas is $1.922 per gallon down 41.17% from a year ago when the average was $3.267 per gallon

-The highest recorded average price by AAA was on 7/17/2008, when the national average was $4.114 per gallon

Note:Data based on preliminary numbers. May adjust slightly due to settling at close.

Comments? Suggestions? Send them tobythenumbers@cnbc.com

Bythenumbers.cnbc.com