Shares in Elpida Memory surged limit up, almost 18 percent after its plan to raise $471 million eased concerns of it breaching debt covenants and reduced the financial risk facing the world's No. 3 DRAM chip maker.

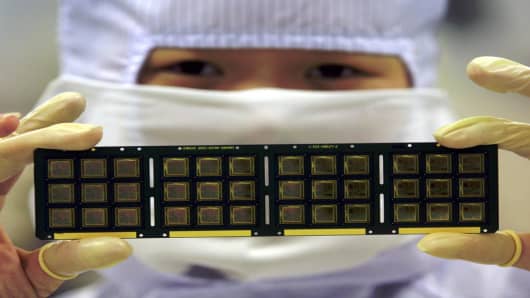

Elpida and other makers of dynamic random-access memory (DRAM) chips, used mainly in PCs, have fallen deep into the red as prices and demand ebb in a prolonged downturn, and analysts say market conditions will likely remain challenging.

Elpida said on Wednesday it would raise 46 billion yen (US$471 million) by issuing mainly preferred shares in two subsidiaries set up this month to five business partners. Sources said the five include wafer maker Shin-Etsu Chemical and Taiwan's Powertech Technology.

Elpida spokeswoman Kumiko Higuchi said the fundraising should boost the level of net assets on its balance sheet enough to enable it to meet a key debt covenant when it closes its books for the financial year on March 31.

The company has also raised its stake in wafer testing firm Tera Probe to make it a subsidiary, in a move seen helping it meet lenders' requirements that it keep its shareholders' equity at at least 75 percent of the previous year's level.

The benchmark Nikkei 225 Average was flat.

"In order for the two moves -- which we see as emergency measures -- to succeed, prices would need to improve significantly," Deutsche Securities analyst Takeo Miyamoto said in a note to clients.

"The financial position of Taiwanese business partner Powerchip is also deteriorating, and may negatively impact the company," he added. Powerchip, however, has signaled the industry could be bottoming out from its worst-ever downturn. Chairman Frank Huang said on Wednesday that memory chip inventories would likely be depleted by June after makers cut output.

Elpida, which is challenging South Korea's Samsung Electronics and Hynix Semiconductor for market share, had been looking to raise money to shore up its balance sheet. It was forced in December to redeem most of a 50 billion yen convertible bond due to a slide in its share price.