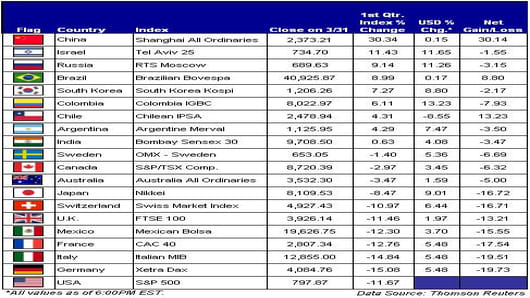

On the eve of the G20 Summit, American investors looking for opportunities overseas are having their returns diminish when converting their investments back into dollars. Here is a look at how major global indexes performed in relation to their respective currency valuations.

Looking back on the first quarter of 2009, nearly every country from our sample below, was significantly impacted by the change in currency values. As the greenback gained a safe-haven appeal amid the global slowdown, global indexes’ performances were negated by their corresponding currency valuations.

European nations were among the hardest hit by declining market indexes and depreciating currency values. Germany’s Xetra Dax Index, for example, fell over 15% in the first quarter, while the euro depreciated about 5.5% versus the greenback making an investment in Germany actually fall by over 19%. The Swiss Market Index posted a drop of 11%, while the Swiss franc depreciated 6.4% versus the US dollar.

Russia’s RTS Moscow Index is another example of how currency fluctuations can impact your overseas investments. The index had a gain of 9.14%; yet, the rubble declined 11.3% versus the US dollar, giving an investor a net loss over 3%. In contrast, an investor was positively impacted in the instance of Chile’s IPSA, where the index rose 4.3% and the Chilean peso climbed 8.6% against the greenback giving a net gain of 13%.

This effect could benefit US Exchange Traded Funds investing in foreign companies, eliminating the currency transaction.

ETFs traded in the United States with exposure to emerging markets include:

- IShares MSCI Emerging Markets Index Fund

- SPDR S&P Emerging Markets

- PowerShares FTSE RAFI Emerging Markets Portfolio

- Vanguard Emerging Markets

- IShares S&P Latin America 40 Index Fund

- SPDR S&P Emerging Latin America

Global Scorecard