Following months of dry activity in the IPO market, signs of investors' confidence in new companies are starting to emerge. DigitalGlobe Inc. , a satellite imagery provider to the government and commercial enterprises, raised $279.3 million in its initial public offering on Wednesday, in a deal led by underwriters Morgan Stanley and JPMorgan. Shares of DigitalGlobe, which will trade at the NYSE under the symbol "DGI," were priced at $19 per share. The estimated range had been $16 to $18 per share.

The Longmont, Colorado-based company brings the count of initial public offerings on a US exchange to five so far this year. Of those deals, four belong to the tech sector. Other companies in the pipeline expected to be unveiled this year include SolarWinds, a network management software corporation, and Open Table, an online restaurant company.

As new corporations venture into the ring, signs of investors' confidence and thirst for what appears to be sound are starting to swell. The awakening of initial public offerings in 2009 follows an 89 percent drop in IPO activity in 2008 compared to 2007 levels on a dollar basis, according to Thomson Reuters data.

The average amount raised during an IPO during the first quarter of 2008 alone stood at $99.87 million, compared to $188.64 during the same period 2007, according to Renaissance Capital, an independent investment research company.

As the markets show signs of recovery, April of this year saw the most activity in the IPO market since July 2008, with Rosetta Stone, Bridgepoint Education, and Changyou.com going public.

During its debut last month, Rossetta Stone raised $112.5 million, with its shares priced at $18 during the deal, but an opening price of $25 per share at the market open. The company's shares, which were priced above their offering range for the first time in about a year, are down about 10% since they started trading on April 16.

On a similar deal, San Diego-based Bridgepoint Education , a higher education provider, sold 13.5 million shares during its initial public offering, raising $141.75 million. Shares of Bridgepoint Education, which were priced below the anticipated range of $14 to $16 per share, closed yesterday at $10.22, down nearly 3% since their opening price.

Other companies that joined the ranks this year, Chinese video-game developer Changyou.com , and baby-formula maker Mead Johnson Nutrition , have seen their stocks trade up 24% and 11.38%, respectively. Adding to the momentum in the IPO market, shares of all five companies experienced gains within the first few trading sessions.

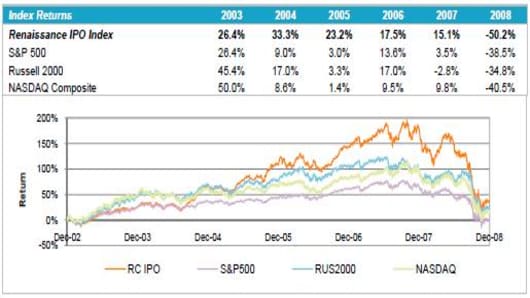

The Renaissance IPO Index, a benchmark of the IPO market performance and activity has gained 18.1% year-to-date, following a 50.2% drop in 2008. The index performance at the end of 2008 was mostly impacted by Financials, which represented 45.35% of the index weighted average.