Investors shifting their focus to opportunities overseas, encouraged by hopes of a recovery led by emerging markets, could see their returns increase as the dollar weakens and global indices rise.

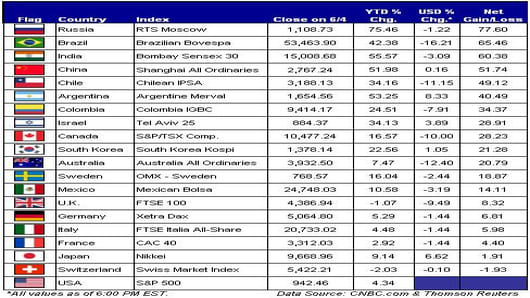

Looking back on the first quarter of 2009, nearly every country from our sample below, was significantly impacted by the change in currency values. As the greenback gained a safe-haven appeal amid the global slowdown, the performance of global indices was negated by their corresponding currency valuations.

However, that trade has reversed its trend since early March, as inflationary concerns due to the rapidly expanding government debt, which has pushed the estimated US budget deficit for this year to a record $1.84 trillion, have cast a shadow on the long-term status of the US dollar as a global reserve currency.

As some emerging markets recover from multi-year lows, in part by signs of improving macroeconomic indicators, sharp currency fluctiations seem to have taken the spotlight. Since the beginning of the year, the dollar index, a measure of the greenback's standing versus a basket of six major currencies, has declined nearly 11% since its highest close in early March, erasing most of its gains during the first quarter of 2009.

A look into the performance of some of the major global indices along with the swings in their corresponding currencies measured against the US dollar, could provide insight into how this relationship translates to multinational corporations and investors.

During the rise of the dollar for the first half of the year, for example, European nations were

among the hardest hit by declining market indices and depreciating currency values. Germany’s Xetra Dax Index fell over 15% in the first quarter, while the euro depreciated about 5.5% versus the greenback making an investment in Germany actually fall by over 19%.

Since early March, the euro has recovered from trading as low as $1.2461 versus the dollar, to recently reaching an intraday high of $1.4336, according to Thomson Reuters data. In about two months, the euro has strengthened nearly 14% from its March lows, trading at around $1.4103 this morning.

Brazil is another clear example of how volatility in the Forex markets could represent a challenge or opportunity to some US-based investors. Consider the Brazilian real, which has appreciated over 20% in the past two months versus the greenback. Paired with the Bovespa's rise, an investor would see a net gain of about 60%, when including a common factor for both calculations. Interestingly, BRIC (Brazil, Russia, India, and China) markets are leading the rebound.

Investors seeking to eliminate the currency transaction, but looking for exposure in emerging economies, could benefit from US Exchange Traded Funds investing in foreign companies.

The following ETFs provide a sample of securities traded in the US with exposure to emerging markets.

- IShares MSCI Emerging Markets Index Fund

- Direxion Daily Emerging Markets Bull 3X

- SPDR S&P Emerging Markets

- PowerShares FTSE RAFI Emerging Markets Portfolio

- Vanguard Emerging Markets

- IShares S&P Latin America 40 Index Fund

- SPDR S&P Emerging Latin America

Global Scorecard

Comments? Send them to bythenumbers@cnbc.com