There's no doubt the recession is winding down. The hot question now is, what shape will the recovery be?

It all depends on how optimistic you are about the recovery—and the economy's prospects for growth.

A recent survey found the debate centers on three components: The speed, strength and durability of the recovery.

"Some of these shapes are dizzying!" said Alyx Kaczuwka, author of the blog LOLFed.com, about all the alphabet theories of recovery.

The three main shapes being tossed around are the "U," the "V" and the "W."

U, the most popular shape, is for those who think we're going to wallow at the bottom a bit before growth begins. The Vs think once it takes off, it'll be a steady climb. And the Ws say — prepare for another dip on this rollercoaster.

The "L," of course, is the doomsday scenario: We hit bottom, and there's no end in sight.

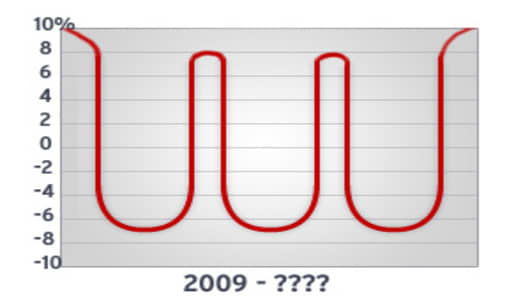

This recession being as extraordinary as it is, there have also been some, well, extraordinary shapes being tossed around in recovery-theory circles. The latest one is the "triple-U" — basically the W's who've grown more pessimistic and think the lows will be low and we'll be on this wild ride for a while.

There are also a few "N" theorists — they're even more optimistic than the V's on the recovery, suggesting once the recovery starts, it will be like a rocket.

A group of "O's" has emerged — mostly critics of the current administration, who think Obama's going to have us going in circles for a while.

And, a couple of wild cards: The "square-root"-shaped recovery, where you take your basic "V" and slap some stagnant growth on the end, and the "Mickey Mouse" recovery when means — well, let's just say there may be a few loop-de-loops.

Fasten your seatbelts and get ready for some of the more bizarre theories of economic recovery!

A 'TRIPLE-U' SHAPED RECOVERY

The "U" theory of economic recovery is quaint and all, but most economists say it's not going to be that simple.

Slap three of them together, and now things are getting interesting.

A "Triple-U" is is the boom-and-bust theory of recovery, where there are a bunch of fits and starts before the economy gets back on its feet.

In a research note titled "The World Is in Trouble," Deutsche Bank Chief Economist Norbert Walter, proposed the triple-U-theory.

“I believe that the rescue packages brought on have been so costly for so many governments that the exit from this fiscal policy will be very painful, very painful indeed,” he wrote.

“Some of us are already talking about a W-shaped recovery," he said. "I’d probably talk about a triple-U-shaped recovery because there are so many stumbling blocks here to get out of this,” including the job market, housing market, consumer spending and all the unwinding the government's going to have to do of assets it bought up to stem the bleeding.

Nouriel Roubini, a professor of economics also known as "Dr. Doom," agrees there is a risk — albeit a slight one — of a double-dip recession.

"I can still see downside risks for financial institutions," Roubini said, citing the growing deficit, which could cause panic among those buying government debt, and the possibility of oil surging back up to $100 a barrel.

"It could lead to a double dip. I'm not saying it's going to happen but it's a risk," Roubini said.

But some market pros said the problem with the Triple-U theory, like the W, is that it presumes all the dips will be equal. If we are going to double — or triple — dip, most say they won't be as severe as the first.

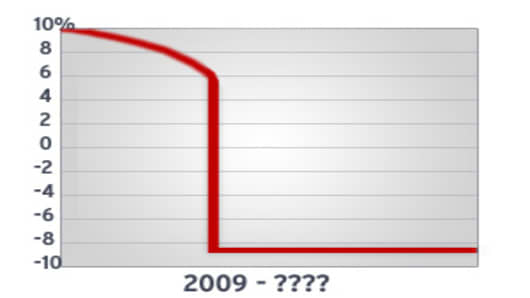

AN 'L'-SHAPED RECOVERY

The L, of course, is the doomsday scenario: We hit bottom, and there's no end in sight.

But, you gotta hand it to 'em — even the L types use a variety of fonts to express themselves.

"It's going to be a slightly upward-sloping 'L,'" said Peter Cohan, a management consultant and venture capitalist.

"The problem is that we are not moving aggressively enough to change our dependence — 70 percent on consumer spending for GDP growth," he explained. "If consumers get canned, they aren't going to be increasing their spending."

The slow housing recovery could also cause the recovery to be L-shaped, said John Sullivan, president of the National Association of Exclusive Buyer Agents, which represents homebuyers only — not sellers.

"We have yet to see all of the subprime foreclosures hit the market and we are just beginning to see the second wave of foreclosures from unemployment," said Sullivan, who pegs this recovery as an L or an angled V. The banks have shown they can't yet handle the tsunami of short sales and foreclosures, Sullivan explained, and at this rate, unemployment is going to be a drag on the housing market for the next two to three years.

"It is going to take a couple of years of flat-lining and another presidential election before I see a gradual recovery," Sullivan said. "Yes, we are going to see the occasional spurt from a specific stimulus, but it wont be enough to bring us out quickly."

So, that's an L — until we get a new president.

Taking the L theory to the next level, we even found one reference to a "lightning-bolt"-shaped recovery— where the economy takes a steep drop and then, just when you start to see some more growth, another sharp drop.

Cohan said it's going to take more government initiatives, like "smart" power grids and alternative energy, to "lead to the kind of business investment that will spur job growth" and move past the flatline of the L.

Cook said there's no way it could be an L, since there are already glimmers of an uptick.

"Unless someone is picturing an 'L' shaped similar to the cursive 'L' on Laverne's sweatersfrom the hit show 'Laverne and Shirley,' I think this one can be ruled out," Cook quipped.

A BATHTUB-SHAPED RECOVERY

For those who think the "U" theory is a little too rosy, there's the bathtub-shaped recovery theory.

It calls for an even more prolonged time at the bottom than the U crowd.

Back at the end of October, when everyone was asking "Are we there yet?," veteran trader Art Cashin, the director of floor operations for UBS, said the recession "is not going to look like a V or a U, it’s going to look like a bathtub and that will carry us longer and further than we would care to be."

And, in May, Symantec CEO Enrique Salem joked that it might even be "an Olympic pool-shaped recovery."

The signal for bath time may come from business inventories, said Barry Ritholtz, who writes the popular Big Picture blog.

"Since I believe consumer spending will remain punk, if inventory restocking doesn’t rebound much after the inventory destocking, a bathtub-shaped recovery(a stretched out U) we will have instead of a V or W," he wrote.

On PBS's Newshour in June, Simon Johnson from the MIT Sloan School of Management, went into detail on what the bathtub shape really means:

It's "a 'U' so long, it might as well be an 'L,'" he explained. "You go in, you stay in. The sides are slippery. You know, maybe there's some bumpy stuff in the bottom — but you don't come out of the bathtub for a long time."

Wow. that sounds scary. Anyone have some nice, calming bath salts?!

A SQUARE ROOT-SHAPED RECOVERY

If you thought the bathtub theory was wacky, how about the square-root-shaped theory.

At first, it sounds ridiculous — trigonometry references always make me giggle — but once you delve into it, it's actually quite plausible.

The theory goes that, once we've touched bottom, we're going to get a bounce, then growth will plateau for a while, until the economy gets fully back on the growth train.

The recession is over, Leon Cooperman, chairman & CEO of Omega Advisors, said on CNBC earlier this week, uttering one of the first references we've heard to the recovery being “square root-shaped.”

"It's long and deeper than anything we've experienced," Cooperman said of the recession. "I think the climb out will be slower because of the loss of the structured-finance market and the inability to do a lot of financial transactions that we did in the last decade. That game is over and it's going to take a long time for memories to fade," he said.

“It’s the result of deleveraging—the consumers have to lift their savings rate, corporations have to improve their balance sheets, and government has to get the house in order,” Cooperman told CNBC. “We have to have a heightened awareness—it’s not business as usual," he said.

Quite a few economists and analysts agree with the theory.

There was the drop to March, followed by a four-week rally, Cook points out. "It is now time for at least a cooling-off period, if not a correction," he said.

Joel Naroff of Naroff Economic Advisors says he expects two quarters of solid growth, starting with the current quarter, followed by two to four years of modest growth in the 2 to 2.5-percent range.

"The initial rapid growth, which I call a 'head fake,' will occur simply because demand has been so low it is easy to get large changes," he explained, citing new car and home sales as examples.

"After a period of time, the financial sector usually helps power the rebound, and it will not be in any shape to do that for at least two more years," Naroff explained.

AN 'O'-SHAPED RECOVERY

And then there's the "O" theory.

It suggests that the economy will fall, then rise in an infinite loop — like a motorcycle stuntman at a circus.

In its broadest sense, you may argue that's what actually happens in the economy — it rises and falls.

But for O theorists, it's more a comment on the effectiveness of the Obama administration's stimulus measures.

This recovery will be "O"-shaped, "since we are going in circles!" said one anonymous trader, who writes "The Fly" blog on iBankCoin.com.

David Levine, CEO of MB Media, joked that it may be an N-O combo.

"You know, the kind of economy that goes straight up, straight down, then straight up, then goes around in circles while the idiots in Washington continue to blow smoke up everyone's rear end about the idea that there actually is recovery!" he said, out of breath.

But he wasn't finished yet. He suggested it could also be a quadruple-O recovery.

"[T]he OOOO recovery could symbolize a recovery that happens as we transition to a society that legalizes and taxes marijuana and decriminalizes it during an economic recovery," Levine joked.

Oh.

A MICKEY MOUSE-SHAPED RECOVERY

Here's where it starts to get a little, um, goofy.

Among the more unconventional shapes for the recovery: Mickey Mouse.

"Personally, I feel, that, since no one accepts the validity or relevance of the [economic] data ... we should be looking for a Mickey Mouse-shaped recovery to develop," said Joshua Brown, VP of investments at Westrock Advisors and the author of the blog TheReformedBroker.com.

It's meant tongue-in-cheek, but is it really so far from the truth?

We get devastated by recession, like a child who's had his favorite toy taken away.

Then, when the economy starts to pick up again, we forget all about it, buying and trading like a kid on a sugar high at Disney World.

Man, I love Space Mountain.

Don't you?

More on CNBC.com:

- Ding, Dong the Recession Is Dead!

- We Are in a Semi-Pression: Nightingale

- Maria Bartiromo: Not Your Grandfather's Recession

- Is China the Key to Preventing 'Lost Decade?'

- Cramer: How to Play the ABCs of Recovery

- Prep for Recovery With These Five Stocks

- Dow 12,000? That's What the Stars Say

- Foreclosures & Short Sales: Are You Buying a Money Pit?

- The National Debt Never Sleeps—and Neither Should You!

- Gimme a Job—Or I'll Sue!

- Watch: Ivanka Trump Interview With CNBC

Questions? Comments? Write to ponyblog@cnbc.com.