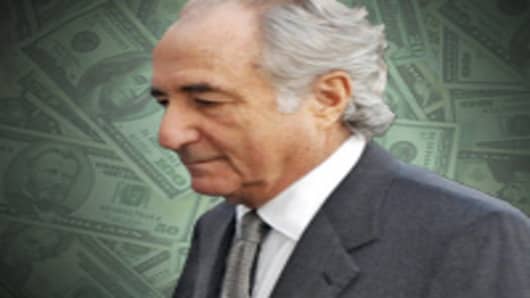

Convicted swindler Bernard Madoff knew how to deal with pesky Securities and Exchange Commission investigators, and in a 2005 phone conversation caught on tape and obtained by CNBC, he tells associates his secret.

"You know, they ask you a zillion different questions and we look at them sometimes and we laugh, and we say, are you guys writing a book?" he said.

Madoff makes the comments in a conversation with two officials of the Fairfield Greenwich Group, Madoff's largest feeder fund, who were about to be questioned by investigators about their firm's relationship with Madoff.

"These guys work for five years at the commission, then they become a compliance manager for a hedge fund now," Madoff says of SEC staffers.

CNBC obtained the audio tape from the Massachusetts Secretary of State's office under the Massachusetts public records law. On Tuesday, Fairfield Greenwich agreed to pay $8 million to settle a complaint by the Secretary of State that it misrepresented its relationship with Madoff to investors. The firm did not admit nor deny guilt.

After the tape's release, Fairfield Greenwich issued a statement aimed at what it calls "misinterpretations" of the Madoff phone call. "Any implication that the Madoff call affected Fairfield's responses to the SEC is demonstrably false," the statement says.

The statement notes that the firm asked for the SEC's permission to speak with Madoff, then told the agency about the call afterward. The firm says that proves its executives "completely ignored" Madoff's much-quoted line about the conversation never having taken place.

"Rather than take Madoff's suggestion to conceal the call, Fairfield Greenwich executives did the opposite," the statement says.

The conversation occurred in December of 2005, as the SEC was conducting one of nearly half a dozen investigations over the years that the agency botched, according to an internal report released by the agency late last week.

In the conversation, which lasts for more than an hour, Madoff sets the tone with the first words out of his mouth: "Obviously, first of all, this conversation never took place...okay?"

Three years later—almost to the day—Madoff confessed to the largest Ponzi scheme in history. He is serving a 150-year prison sentence. Fairfield Greenwich Group, the firm on the other end of the line, faces numerous civil suits, including a $3.4 billion complaint by Madoff bankruptcy trustee Irving Picard.