Today, the Bureau of Labor Statistics released its producer price indexfor the month of August, which increased a sharp 1.7%, which was twice the consensus forecast-mostly because of an 8.0% increase in energy prices. Gasoline prices were the culprit; up a whopping 23% for the month. Excluding food and energy, the producer price index was up a much smaller 0.2%, a tenth of a percentage point more than expected. On a year-over-year basis, the headline figure is down 4.3%, up from -6.8% in July, which was the largest year-over-year decline since recordkeeping began in 1948.

Deflation such as this has contributed to the low level of market interest rates. The question is now twofold: will deflation turn toward inflation, and if so how will it affect market interest rates?

To begin our analysis, let’s take a closer look at today’s report to see what if anything can be gleaned about the outlook for inflation data. I’ll start with the “pipeline” producer price figures, which measure prices at earlier stages of the production prices and hence presage prices of finished goods, which produce the headline figure. As an example, consider a shirt. The crude material is cotton from the field; the intermediate material is cotton yarn; the finished good is the shirt.

Crude, Intermediate Prices are Rising

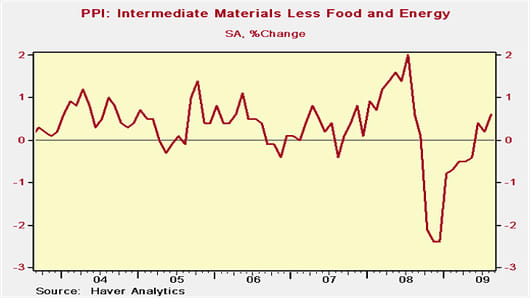

Core crude prices, which are prices at the earliest stage of the production process, increased 6.0% in August, which was the fifth consecutive monthly gain and the most since April 2008. Core intermediate prices, which are prices at the middle stage of the production process, increased 0.6% in August, marking the third consecutive monthly gain following eight months of declines and the largest gain since August 2008, when it also increased 0.6% (see chart).

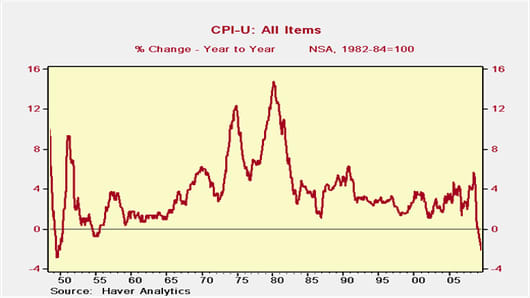

Headline figures for crude and intermediate goods prices have also increased sharply, which is a reminder of the change ahead for headline consumer price data, which on a year-over-year basis will swing from a 60-year low of -2.1% (see chart) to positive territory in a matter of months. This is because last year’s plunge in headline prices will be removed from the year-over-year equation. Recall that there were decreases of 0.8%, 1.7%, and 0.8% in the consumer price index October through December 2008, respectively. These will fall out of the equation and result in a reading of greater than zero, unless the sharp declines repeat.

The Swing Could Affect Bond Market Sentiment

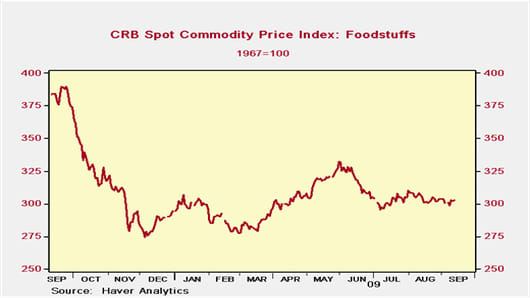

The psychological impact of the shift on the bond market can’t be known and no profound affect is likely, but headline figures won’t be as firmly entrenched in the positive side of the sentiment ledger when the data turn. Inflation expectations will nonetheless be kept in check by because of the widely notion that inflation lags the economic cycle by as much as two years. Fundamental factors that will restrain economic growth and limit inflation include slow income growth, the effects of wealth destruction on consumption, the lack of credit availability, increased regulation--particularly for financial institutions (this relates to the last point), and an eventual end to or reduction in fiscal stimulus. Another factor in the near-term is the fact that the price of oil and commodity indexes for foodstuffs have stalled (see chart on foodstuffs).

Still, there are enough monetarists out there who worry about all of the money injected into the financial system by both the Federal Reserve and the world’s central banks to believe that inflation expectations can move above the likely path for actual inflation and in the process influence market interest rates.