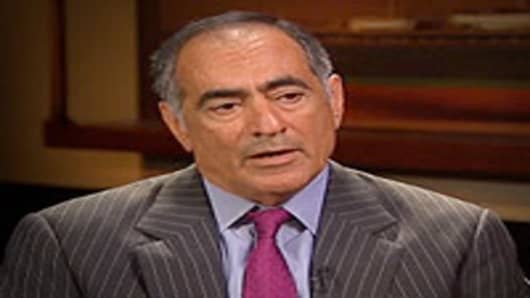

The financial system needs more efficient regulation that would happen by streamlining, not expanding, the current mechanisms, Morgan Stanley CEO John Mack told CNBC.

Among the ideas Mack said he would endorse include a global manager of systemic risk, an idea related to the notion that institutions such as Morgan were too big to fail during the financial crisis of 2008.

"We have too many different regulators," Mack said in a live interview. "There needs to be a pulling together, a consolidation."

The financial system as a whole is getting stronger, he said, though he added that things are better outside the United States.

"Clearly it's improving. I think one of the reasons people feel so good is the capital market's open again," Mack said. "People feel better, they know the world's not going to collapse. But the real growth is overseas, in the foreign markets. Here in the US we're making progress but it's very slow."

Mack did not directly address the issue of whether compensation is too high for Wall Street executives, saying the focus should be more on whether companies are creating jobs and meeting their obligations to shareholders.

Pay for top managers emerged as a thorny issue during the credit crisis after disclosures were made about multi-million-dollar bonuses doled out at companies that received government bailout funds.

"Wall Street clearly has not done everything right, but we're representing our shareholders and we are making money for them," Mack said. "Enough's enough, and we are hiring people, we are doing our part."

While Mack said he does expect stocks to have some type of pullback, he doubted the market would return to its March lows at the depths of public confidence.

"That was just an overreaction. That was panic," he said. "When we get through this, a year from now we're going to have a stronger economy."