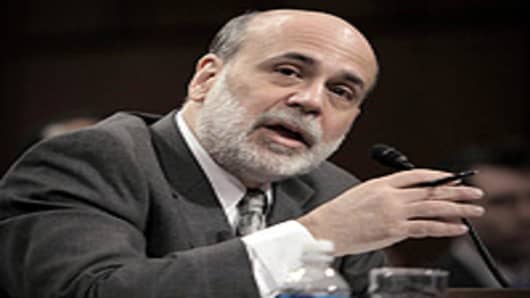

U.S. Federal Reserve Chairman Ben Bernanke Friday laid out his most detailed description yet of the central bank's post-crisis approach to regulation and said requiring big banks to hold more capital was under consideration.

Speaking at a conference sponsored by the Boston Federal Reserve Bank, Bernanke outlined a number of steps regulators around the globe are mulling to lower the risk that any one firm's problems could destabilize the financial system.

He said regulators were also consider requiring a greater share of bank capital be held in the form of common equity, and a possible call for some firms to issue contingent capital, a debt-like security that can convert to equity in times of stress.

"We are working with our domestic and international counterparts to strengthen the standards governing bank capital, liquidity, risk management, incentive compensation and consumer protection, among other areas," Bernanke said.

Leaders of The Group of 20 major economies agreed in Pittsburgh last month to find ways to change the behavior of banks and rein in the type of excessive risk-taking that fueled the credit crisis that shook the world's financial system last year.

On Thursday, the Fed stepped into the thorny issue of executive compensation, issuing guidelines to tie compensation at the thousands of banks it regulates more closely to the risks those firms take.

Bernanke Presses for Action on Reforms

On Friday, Bernanke said it was imperative to push forward with regulatory reforms even though financial conditions had "improved considerably."

"With the financial turmoil abating, now is the time for policymakers to take action to reduce the probability and severity of any future crises," he said.

New York Federal Reserve Bank President William Dudley, in remarks to a banking group on Oct. 13, had discussed the possibility of a capital surcharge for systemically important banks.

Dudley said imposing a surcharge would be one way to tackle the problem of some banks being viewed as "too big to fail," or having the implicit guarantee of government support.

Bernanke said that to beef up oversight, which he acknowledged fell short in spotting risky practices that contributed to the meltdown, the central bank would conduct more comprehensive reviews of banks and demand more reporting.

Responding to a question from the audience, he said the Fed is unlikely to repeat the extensive stress-tests done on major U.S. banks earlier this year.

Still, "many of the lessons, particularly looking at the system as a whole, trying to identify system-wide exposures, system-wide practices that pose risks, will be part of our basic tool-kit going forward," he said.

The Fed's examination of capital buffers at the nation's 19 largest banks earlier this year helped restore confidence in the financial system and made it easier for banks to raise private capital.

"We will conduct more frequent, broader, and more comprehensive horizontal examinations," Bernanke said. U.S. regulators traditionally have conducted bank-by-bank examinations.

Demanding extra capital for banks that are too big to fail makes sense, said Ray Soifer, an independent bank consultant in Green Valley, Arizona. Such banks are getting an implicit government guarantee for free, so there is merit to creating a cost for that expected support, Soifer said.

Congress is wrestling with regulatory reforms aimed at avoiding a repeat of the crisis that helped push the U.S. economy into its deepest recession since the 1930s.

President Barack Obama has pushed lawmakers to wrap up their efforts by year-end, but the process is likely to drag into next year as Congress wrangles over details.

Another senior Fed official said authorities need to cooperate across borders to plug gaps in financial oversight and prevent a repeat of the recent financial crisis, even as national authorities adopt local approaches.

"Deficiencies must be fixed on a global basis to forestall gaps and regulatory arbitrage that could undermine the effectiveness of regulation," Federal Reserve Vice Chairman Donald Kohn said at the same conference as Bernanke.

"But at the same time, regulations must be passed and implemented nationally," he said.