WHEN: TODAY, MONDAY, NOVEMBER 16TH AT 4:30PM ET

WHERE: CNBC'S "CLOSING BELL WITH MARIA BARTIROMO"

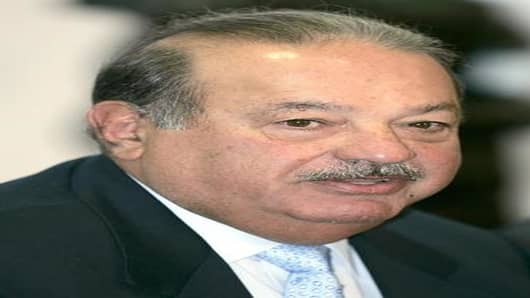

Following is the unofficial transcript of a FIRST ON CNBC interview with Carlos Slim, Telmex Foundation President, today, Monday, November 16th on CNBC's "Closing Bell with Maria Bartiromo" at 4:30PM ET.

All references must be sourced to CNBC's "Closing Bell with Maria Bartiromo."

----------------------------------------------------------------

BARTIROMO: WELCOME BACK.FORBES MAGAZINE RANKS HIM THE THIRD RICHEST MAN IN THE WORLD BACK IN MARCH. CARLOS SLIM MAY BE THE WEALTHIEST WITH ONE OF MEXICO'S TOP ONLINE NEWS SITEA SAYING HE'S SURPASSED BILL GATES AND WARREN BUFFETT FOR THE SPOT GLOBALLY. SLIM HAS A HEAVY HAND IN THE TELECOM SPACE CONTROLLING 90% OF MEXICO'S LANDLINE BUT THE BILLIONAIRE HAS BRANCHED OUT OVER THE LAST YEAR. LAST YEAR TAKING STAKES IN "THE NEW YORK TIMES," INDEPENDENT NEWS AND MEDIA ALONG WITH BRONCO DRILLING. WE'LL GET TO CARLOS SLIM MOMENTARILY. BUT FIRST TO BREAKING NEWS RIGHT NOW AND TYLER MATHESON AT THE NEWSDESK...KEEPING WITH THE BILLIONAIRE INVESTOR FOCUS AND WHAT THEY'RE DOING, EARLIER I SPOKE WITH THE TELECOM TITAN CARLOS SLIM, ABOUT HIS INVESTMENTS AND THE OVERALL STATE OF LATIN AMERICA'S ECONOMY. LET ME ASK YOU BROADLY SPEAKING RIGHT NOW, CARLOS, WHAT YOU CAN TELL ME ABOUT MEXICO, AND THE LATIN AMERICAN REGION IN TERMS OF THE ECONOMY. ARE YOU SEEING RECOVERY THERE?

SLIM: WELL, IT WAS INTERESTING. THERE IS A DIFFERENCE WITH U.S. AND EUROPE, AND THE DEVELOPED COUNTRIES, BECAUSE YOU BEGIN WITH A BIG FINANCIAL CRISIS.AND THEN THE CONTAMINATION OF THE REAL ECONOMY. AND WE HAVE NOT HAD ANY FINANCIAL CRISIS. THE SITUATION -- THE FINANCIAL SITUATION IN MEXICO, AND IN LATIN AMERICA IN GENERAL, IS NOT WITH THE FINANCIAL SECTOR. IT'S THE DECREASE IN THE TRADE AND THE U.S. ECONOMY AND DEVELOPED COUNTRIES' ECONOMY THAT WE SUFFER IN BECAUSE OF THAT. BUT THE FINANCIAL INSTITUTIONS ARE IN GOOD SHAPE, VERY WELL CAPITALIZED. AND WE FOLLOW THE CREDIT WHICH IS IMPORTANT FOR THE REAL ECONOMY.

BARTIROMO: AND WHAT CAN YOU TELL US ABOUT THE BANKING SYSTEM AWAY FROM LATIN AMERICA AND MEXICO?I KNOW YOU HAVE BEEN AN INVESTORIN THE BANKING SECTOR. YOU HAD BOUGHT CITIGROUP A WHILE BACK.

SLIM: NO, NO.NO. WE HAVE A FINANCIAL GROUP, BANKING, FROM 1965. THIS MONTH IS 44 YEARS IN THE FINANCIAL GROUP OF OURS. I FOUNDED IT IN 1965. I WILL TELL YOU THAT NOT ONLY IMBUSA IS THE NAME OF OUR FINANCIAL GROUP, ALL THE BANKS IN MEXICO ARE IN GOOD SHAPE.AND THERE'S NOT A PROBLEM OF CAPITAL, OR BIG LOSSES.AND THAT'S A GOOD THING FOR OUR COUNTRY. WE HAVE HEALTHY FINANCIAL INSTITUTIONS IN THE FINANCIAL SECTOR.

BARTIROMO: ARE THERE OPPORTUNITIES IN THE BANKING SECTOR THAT YOU SEE IN THE UNITED STATES?

SLIM: I WON'T TALK ABOUT, SAY, MEXICO. WE HAVE A LOT OF POTENTIAL, BECAUSE THE BANK CREDIT IS REALLY, REALLY VERY LOW IN TERMS OF THE GROSS NATIONAL PRODUCT. WHEN THE U.S., YOU KNOW, THAT THE -- FOR SOME INSTITUTIONS, THEY ARE CLEANING UP. AND YOU KNOW NOW THAT THE SPREAD BETWEEN THE MONEY THEY PAY AND THEY CHARGE IS BIG. THAT HELPS A LOT FOR THE BANKING SYSTEM TO GET IN BETTER SHAPE WORLDWIDE. YOU KNOW, THE MONEY, THE RAW MATERIAL OF THE BANKS, VERY LOW PRICE. AND THERE IS A LOT OF MONEY.AND WITHOUT COST. THAT'S A GOOD THING FOR THE BANKS IN THE U.S. AND EUROPE.

BARTIROMO: WHERE IS THE GROWTH COMING FROM RIGHT NOW DO YOU THINK?WHAT SECTORS, AND WHERE ARE YOU SEEING THE MOST ACTIVITY IN TERMS OF GROWTH THROUGHOUT LATIN AMERICA AND IN MEXICO?

SLIM: WELL, I THINK BEING THE MAIN PROBLEM IN THE REAL ECONOMY, EMPLOYMENT. I THINK WE NEED TO INVEST IN ALL LATIN AMERICA, IN INFRASTRUCTURE AND IN HOUSING, BUT MAINLY IN INFRASTRUCTURE I THINK ANOTHER ACTIVITY THAT SUPPORTS THE EMPLOYMENT AND MAKE IT IMPORTANT FOR OUR COUNTRIES. AS MUCH AS YOU HAVE MORE PEOPLE WORKING, YOU HAVE A BIGGER MARKET, A BIGGER ECONOMIC ACTIVITY, AND THAT HELPS A LOT. THAT'S WHY I SEE THAT IT IS VERY IMPORTANT FOR US, INCLUDING THE DEVELOPED COUNTRIES, TO MAKE INFRASTRUCTURE.AND TRY TO MAKE STRONGER OUR MIDDLE CLASS. ALL THE DEVELOPED COUNTRIES HAVE GREAT DEVELOPMENT OF INFRASTRUCTURE, AND MIDDLE CLASS SECTOR IS VERY BIG.

BARTIROMO: IN TERMS OF TELECOM RIGHT NOW, CARLOS, THE LATIN AMERICAN PHONE AND CABLE TV COMPANY, TELEMEX, I WANT TO TALK ABOUT WHETHER IT'S SATELLITE TELEVISION, AND INTERNET, IN BRAZIL, AND SORT OF WHERE THE GROWTH IS WITHIN TELECOM. ARE YOU SEEING INCREASINGLY PEOPLE MOVE TOWARD SATELLITE ANDINTERNET VERSUS WIRE LINE BUSINESS?

SLIM: WELL, I THINK INTERNET HAS A BIG POTENTIALWORLDWIDE, IS IS THE LATERAL SYSTEM OF THE NEW SOCIETY, AND VERY IMPORTANT IN THIS SOCIETY OF KNOWLEDGE AND INFORMATION AND TECHNOLOGY, TO HAVE A UNIVERSAL ACCESS TO THESE SERVICES.WE KNOW IN LATIN AMERICA, YOU KNOW, WE HAVE 85% PENETRATION IN LATIN AMERICA, IT'S VERY HIGH. HIGHER THAN SOME DEVELOPED COUNTRIES. AND WE ARE LOOKING TO DO THE SAME IN LATIN AMERICAN BROADBAND. AND WE'RE GOING BY THE WORLD WAY, WE HAVE A FIVE-YEAR GROWING IN MEXICO, LIKE 70% A YEAR. AND THIS IS VERY -- IT'S VERY GOOD FOR THE COUNTRY AND GOOD FOR THE TELECOMMUNICATIONS, THAT PRICES ARE GOING DOWN AND DOWN, BECAUSE TECHNOLOGY IS MAKING IT MORE EFFICIENT AND CHEAPER. AND I AM VERY CONFIDENT THAT IN THREE YEARS, MAYBE 2/3 OF LATIN AMERICA HAS ACCESS TO THE INTERNET. AND BROADBAND.

BARTIROMO: WHICH I GUESS IS ONE OF THE REASONS YOU'RE SEEING MOBILITY TAKE OFF. THERE ARE SO MANY MORE MOBILE PHONES THAN ACTUALLY PCs IN THE WORLD.

SLIM: WELL, COUNTRIES ARE NOT SO MUCH PCs.THAT'S WHAT WE ARE SUPPORTING, AND SELLING PCs TO MAKE IT FEASIBLE TO OUR CUSTOMERS TO HAVE THE PC, AND THE CONNECTION. WILL BE BY THE TWO WAYS AND BY THE MOBILE WAY. THE BROADBAND IN THE WORLD LINE OF THE BIG DIMENSION IS ALREADY IN THE MARKET. IT MAY TAKE US A LITTLE MORE. AND THE ACCESS TO THIS KIND OF BROADBAND IS VERY IMPORTANT TO US.

BARTIROMO: AND AS THE ECONOMY GROWS, ANDYOU'RE SEEING VIBRANCY IN CERTAIN AREAS, YOU ARE ACTUALLY BETTING ON THAT CONTINUATION OF A MEXICO RECOVERY BY INVESTING IN INFRASTRUCTURE PROJECTS, IS THAT RIGHT?

SLIM: YES, WE ARE INVESTING IN INFRASTRUCTURE, BUT ALSO IN HOUSING AND REAL ESTATE DEVELOPMENT. AND THAT'S VERY IMPORTANT THAT IT'S A GOOD MOMENT TO INVEST, I BELIEVE. IN THESE AREAS. IN THESE AREAS IN PARTICULAR, IT'S VERY INTERESTING, AND VERY GOOD FOR EVERYONE, FOR THE COUNTRY, FOR THE ECONOMY, FOR THE EMPLOYMENT, FOR THE INVESTORS.

BARTIROMO: WHERE SPECIFICALLY ARE YOU LOOKING FOR OPPORTUNITIES IN TERMS OF INFRASTRUCTURE?WHERE DO YOU THINK WE WILL SEE THE MOST BUILD-OUT?

SLIM: WELL, HIGHWAYS, WATER TREATMENT, ENVIRONMENT IS VERY IMPORTANT, AND NEW ENERGIES, ALTERNATIVE ENERGIES. BUT ALSO ALL THE ENVIRONMENT ISSUES, VERY IMPORTANT FOR INVESTMENT. POWER, WATER, WATER TREATMENT, PORTABLE WATER, ALL AROUND THE WATER TREATMENT OPERATION.

BARTIROMO: MY THANKS TO CARLOS SLIM JOINING US. HE WAS IN WASHINGTON TODAY.

BARTIROMO: WELCOME BACK. BILLIONAIRE INVESTOR CARLOS SLIM MADE HIS MONEY IN TELECOM, HE'S ALSO EYEING ANOTHER AREA, INFRASTRUCTURE. MORE OF MY FIRST ON CNBC INTERVIEW WITH MR. SLIM AND EXACTLY WHERE HE'S PUTTING HIS MONEY. YOU MADE A POINT RECENTLY SAYING YOU'RE NOT GOING TO MAKE MONEY IF YOU KEEP YOUR MONEY IN TREASURIES AND NOT DOING ANYTHING WITH IT. YOU'RE LOOKING TO GET ON THE BANDWAGON FOR THOSE INFRASTRUCTURE PROJECTS FOR REAL RETURN.

SLIM: THAT IS VERY IMPORTANT. BECAUSE NOW MORE THAN EVER, I HAVE EVER SEEN IN MY PROFESSIONAL LIFE, LOW RATES LONG TERM. WHEN YOU HAVE MONEY AVAILABLE ATLOW INTEREST RATES AND LONG TERM, MOST OF THE PROJECTS ARE PROFITABLE, OR FEASIBLE. THE POSSIBILITY TO MAKE A RATE AT 5%, AT LEAST 10% OR 50%.THAT IS WHAT IS A GREAT MOMENT WITH THESE LOW INTEREST RATES, AND LONG-TERM -- INVESTING IN LONG-TERM PROJECTS.

BARTIROMO: SPEAKING OF LOW INTEREST RATES, WHAT ABOUT THE UNITED STATES RIGHT NOW, CARLOS?ARE YOU INVESTING THERE?

SLIM: YES, WE DO NOT TRACK MOBILE WIRELESS INVESTING, AND THAT'S WHERE MY MAIN INVESTMENT IS. BUT I THINK THAT THE IDEA THAT THE LOW INTEREST RATES IS SO IMPORTANT FOR INVESTMENT IS CLEAR. THE ALTERNATIVE TO HAVE SO LOW INTEREST RATES LOSING NEGATIVE INTEREST RATES, YOU FIND MANY ALTERNATIVES. AS WELL, IF IT STAYS FOR A LONG TIME, THAT YOU CREATE NEW OVERVALUATION OF ASSETS, LOW INTEREST RATES INCREASE THE VALUE OF ASSETS.THAT'S MORE IMPORTANT TO MAKE INVESTMENT FEASIBLE.

BARTIROMO: WHAT ABOUT OIL EQUIPMENT AND OIL SERVICES BUSINESS OUTSIDE OFMEXICO? OIL PRICES HAVE STAYED AT SIZEABLE LEVELS, ABOUT $78 A BARREL TODAY.

SLIM: YES, I THINK OIL PRICES ARE STILL AT A HIGH IN COMPARISON WITH THE THREE, FOUR, FIVE YEARS AGO. LAST YEAR IS GOES VERY HIGH BECAUSE OF THE WEAKNESS OF THE DOLLAR. BUT FOR COUNTRIES LIKE OURS, THERE ARE A LOT OF POTENTIAL IN OIL IN DEEP WATERS BUT ALSO IN SHALLOW WATERS ANDIN LAND. WE ARE SUPPLIERS OF OIL PLATFORMS AND MAKING DRILLING IN LAND FOR MEXICO.

BARTIROMO: WHAT CHANGES THE SITUATION THERE?WOULD YOU EXPECT ANYTHING ON THEHORIZON TO REVERSE THE COURSE OF OIL PRICES RIGHT NOW? THE ENTIRE COMMODITIES SECTOR HAS REALLY BEEN ON FIRE.

SLIM: WELL, THE PRICES OF OIL, LIKE I WAS TELLING, IS IN GOOD SHAPE. THERE IS NOT AN ALTERNATIVE THAT CAN MOVE THE BAN OF OIL, ESPECIALLY WHEN THE ECONOMY RECOVERS WE'LL BE A MORE -- A HIGHER CONSUMPTION.THAT'S WHY FOR THE COUNTRIES THAT ARE OIL PRODUCERS IS IMPORTANT AND ATTRACTIVE TO INCREASE INVESTMENT IN EXPLORATION. BUT ALSO, TO TAKE OIL OUT OF THE DEPOSITS.

BARTIROMO: AND MY THANKS TO CARLOS SLIM JOINING US FROM WASHINGTON TODAY.

About CNBC:

CNBC is the recognized world leader in business news, providing real-time financial market coverage and business information to more than 340 million homes worldwide, including more than 95 million households in the United States and Canada. The network's Business Day programming (weekdays from 5:00 a.m.-7:00 p.m. ET) is produced at CNBC's headquarters in Englewood Cliffs, N.J., and also includes reports from CNBC news bureaus worldwide. Additionally, CNBC viewers can manage their individual investment portfolios and gain additional in-depth information from on-air reports by accessing http://www.cnbc.com.

Members of the media can receive more information about CNBC and its programming on the NBC Universal Media Village Web site at http://nbcumv.com/cnbc/.