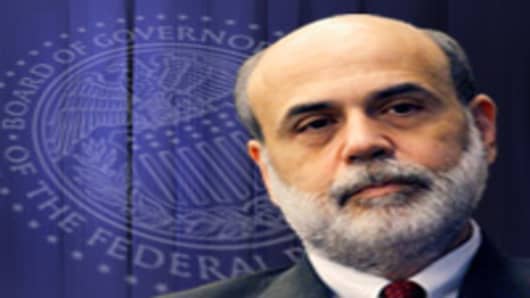

U.S. Senator Bernie Sanders said on Sunday he will not vote to reconfirm Ben Bernanke as chairman of the Federal Reserve, in a preview of the rough treatment Bernanke may get this week on Capitol Hill.

The central bank chief will testify on Thursday before the Senate Banking Committee at a hearing on his nomination to a second four-year term. The session could be difficult, with the Fed under fire from across the political spectrum.

The open opposition of Sanders, an independent outside the political mainstream, is unlikely alone to derail Bernanke's renomination. But it reflects the Fed's challenges.

"I absolutely will not vote for Mr. Bernanke. He is part of the problem," Sanders said on ABC's "This Week" TV program.

Bernanke "didn't ... do anything to prevent us from sinking into this disaster that Wall Street caused and which he was a part of," Sanders said, referring to last year's severe financial crisis and the deep recession that followed.

Under Bernanke's leadership, the Fed has greatly expanded its role in the economy, moving beyond its core monetary policy function to financing emergency bailouts of major financial firms in an attempt to stem the capital markets crisis.

Along the way, the Fed has drawn sharp criticism from skeptical lawmakers, some of whom are now moving to check the Fed's power and expose its decisions to greater scrutiny.

In a more tempered assessment of Bernanke's record, Republican Senator Lindsey Graham told the ABC that the Fed chief has done a good job and has made bold decisions "that kept the economy from going into a depression."

But, he added, "We need more transparency and accountability ... The Fed needs to be looked at closely."

In an unusual move, Bernanke on Friday spoke out in a column in The Washington Post against attempts to strip the Fed of some of its regulatory responsibilities and to expose it to audits by a congressional watchdog.

Such steps would "impair the prospects for economic and financial stability in the United States," he said.

A proposal to audit the Fed's monetary policy deliberations won a committee vote earlier this month over the objections of House Financial Services Committee Chairman Barney Frank.

Senate Banking Committee Chairman Christopher Dodd is the author of a proposal to consign the Fed solely to making decisions about setting benchmark interest rates, stripping it of bank supervision and consumer protection duties.

Frank has said the audit provision in the House is likely to be revisited as legislation comes up for floor action.

Dodd has said his proposal is a starting point for debate.