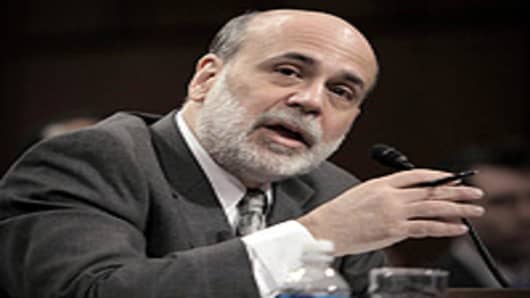

Federal Reserve Chairman Ben Bernanke emerges from his bruising confirmation fight battered but not broken as the central bank looks to chart the next step in the nascent economic recovery.

After finally winning Senate confirmation for a second term, Bernanke's future is clouded primarily by questions over whether the Fed can maintain its independence or will be burdened more than ever by political considerations.

In recent weeks congressional leaders have served up withering criticism of monetary policymakers, directing much of their wrath at Bernanke and Treasury Secretary Timothy Geithner.

Coming out of the political storm, Fed scholars largely expect Bernanke to nevertheless hold a steady hand over the central bank. But he will need to convince Congress—as proxy for the public—that the Fed is as concerned about Main Street as it has been about Wall Street.

"Congress reflects the public dissatisfaction," says Alan Meltzer, a professor at Carnegie-Mellon University and leading Fed scholar. "What is the public dissatisfied about? Mostly that the Fed bailed out AIG, the banks, General Motors Acceptance Corp, Chrysler, and hasn't done much for them. That's reflected in the political dissatisfaction that the Fed is undergoing."

Meltzer compares Bernanke's political fix to that of former Fed chairman Paul Volcker, who faced severe pressure when he sought to drag the country from beneath its crushing inflation burden in 1981-82. Home builders sent him two-by-fours in the shape of crosses to protest policies they felt were devastating the industry.

In response Volcker hit the road and spoke face to face with the builders, earning an ovation if not total agreement on the way to delivering the economy from its inflation burden. Bernanke could learn some lessons from his predecessor, whose latest role is as an adviser to President Obama.

"They gave him a standing ovation not because they liked what he was doing but because they admired his willingness to come and (talk to) them," Meltzer says. "Bernanke hasn't done enough to sell his policy to the public, to explain to the public why the Fed is doing what it's doing."

Indeed, Bernanke will have to sharpen his political skills in his second term as Congress continues to hone its attacks and with maverick Rep. Ron Paul's (R-Tex.) proposal gaining steam to audit the Fed.

A surrendering of political authority would be not merely a slap against the current chairman but would leave a welt that successors would feel as well.

"He and the Fed are seriously wounded and I don't know how it ends, but I think we will wind up with a Fed that is weakened substantially," says Bill Isaac, former FDIC chairman during the savings and loan crisis in the 1980s and chairman of global financial services for LECG. "The Fed's independence will likely be eroded to a significant extent. Its power will probably be reduced to do things like it did this time around and in prior crises."

Bernanke has in some cases unfairly taken the blame for decisions made by others, Isaac says.

"The mistakes that were made were made by the Treasury, not the Fed," he says. "The Fed was taking its cue from the Treasury. I think the Treasury led them down the path that caused enormous political damage across the board, not just to the Fed but to the entire financial services industry. There is a tremendous political backlash and I don't think that's a good thing."

Yet it may be the suffering of those slings and arrows that will restore some of the lustre taken off Bernanke's profile.

He has become the principal lightning rod for the other Fed governors who were participants in the central bank's most controversial decisions and that will boost his standing at least among his peers, says Robert Litan, vice president of research and policy at the Kauffman Institute in Kansas City.

Bernanke, Litan adds, is likely only gearing up for one more stint in the chairman's seat and is not looking for a lifetime appointment.

"He's like a second-term president," says Litan, also a senior fellow at the Brookings Institute in Washington, D.C. "He's not looking to stay at the Fed for the rest of his life. He needed to stay to vindicate what he has done, and frankly he deserves to stay for helping save the world economy."

Litan adds: "In four years, he doesn't need this anymore. That liberates him to behave the way he was going to anyhow."

The difficult experience likely has given Bernanke thicker political skin, something he will need once the Fed starts taking away its alphabet-soup liquidity programs and rate hikes.

Dan Seiver, finance professor at San Diego State University, facetiously takes a line from Monty Python to say Bernanke has suffered "only a flesh wound" that may be aggravated as the Fed chairman navigates the recovery process.

"It will be time for them to tighten at some point and that will create screaming. My guess is the decibel count will be even higher because of the dust-up over his reappointment," Seiver says. "You could say he just has a flesh wound, but he also has two black eyes. He's hurt a little bit but with the proper rest and relaxation he'll recover from that."

With his wounds bandaged and the economy erasing armageddon scenarios, Fed watchers think the chairman mostly should stay the course for his second term but remain mindful of landmines.

"Do the right thing and do not worry about what the reaction on the Hill is going to be," Litan says when asked what advice he would have for Bernanke. "You've already lived through the worst of it. What else can they do to you?"