Recent economic data has raised investor hopes that a resurgent US consumer will lead a "V-shaped" recovery rather than the "U-shaped" version that many economists had previously expected.

Specifically, retail sales for March came in at a better-than-expected +1.6%, personal consumption expenditures have growth for several straight months, and monthly same-store sales results were strong for most retailers. From the April 15 edition of the Wall Street Journal:

"Since the economy turned toward growth in mid-2009, economists have offered a litany of reasons that the recovery should be exceedingly sluggish. Heavy debt burdens would weigh on consumer spending, wounded banks would pull back on lending, and a glut of foreclosed homes would keep house prices and construction activity down. Many of those factors are still in play—and even the most optimistic estimates of U.S. growth remain well below the 7% to 8% level seen in the wake of previous deep recessions. Bank lending has been shrinking at the fastest rate in more than six decades, the supply of foreclosed homes turned up in early 2010 and construction activity remains subdued. What's different, though, is that those headwinds aren't holding back U.S. consumers. Economists now expect inflation-adjusted consumer spending to grow at an annualized rate of more than 3% in the first quarter, up from earlier estimates of less than 2%. As consumers shed an increasing amount of debt through defaults, and as the government implements new incentives for banks to forgive mortgage principal, the added relief could help keep the spending going."

Readers with any financial responsibility may find this difficult to fathom. The Journal is attributing the recent increases in consumer spending to the fact that overly indebted individuals have had their slates wiped clean. Now, it is being suggested, these reckless spenders are free to run up the tab again. As crazy as this sounds, it might make actually sense if there were anyone around to lend them the money.

In my humble opinion, our explanation is more plausible. First, there is obviously a certain degree of pent-up demand by all consumers following a year in which belts were tightened more than at any other time in decades. Consumers put off major purchases while discount stores like Wal-Mart benefited from a new-found sense of frugality across income levels. Second, we all heard stories during the recession about how wealth-flaunting was "out" and frugality was "in."

What we are seeing now, in our opinion, is the well-to-do are going back to their free-spending ways. High-end retailers of all stripes have posted some meaningful sales increases in recent months as more affluent consumers bask in their stock market gains.

In a nutshell, we are still seeing the same kind of bifurcated retail market that we saw for much of the 2000s - more affluent consumers are driving the spending gains while moderate and lower-income consumers continue to suffer from stagnant incomes (if they have jobs at all).

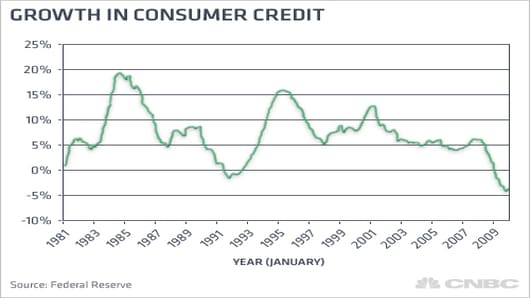

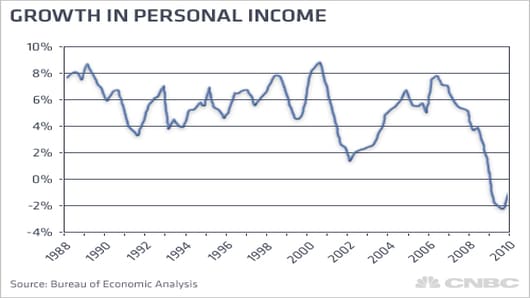

What is clear is that the recent strength in consumer spending is not supported by the typical drivers of spending: income and credit growth. According to the Federal Reserve, consumer credit decreased for the twelfth straight month in February - the largest and longest contraction in consumer credit since the Fed started tracking this metric in 1943. And according the Bureau of Economic Analysis, personal income has contracted for four straight quarters (on a YOY basis).

In the fourth quarter of 2009, personal income remained below the level reported for the fourth quarter of 2007. While incomes have rebounded modestly in the first two months of 2010, the gains have not been enough to support a strong rebound in consumer spending.