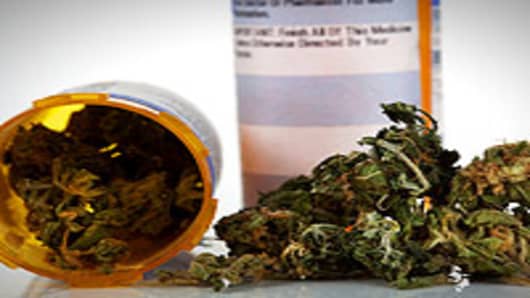

Medical marijuana has gone high profile.

The state of New Jersey approved it starting in August. Iowa pharmacists are recommending its legalization for medical patients in the Hawkeye State. At the same time, a dispensary in Montana was firebombed this week , and Los Angeles is facing lawsuitsover plans to attack the explosion in dispensaries by slashing their number.

Marijuana is now legal for medical purposes in over a dozen states . But paying for it as a medical expense is still a non-starter. ?

Why can't you use your Health Savings Account or Flexible Spending Account to pay for it? After all, this money is set aside specifically to cover all kinds of medical costs, from prescriptions to Band-aids (though the new healthcare law restricts coverage to prescriptions only starting next year).

"Hmmm," said Yami Bolanos, who runs the Purelife Alternative dispensary in Los Angeles. "I have heard of some people taking their receipts to Medi-Cal or their insurance companies to get reimbursement, but I don't know about the HSAs."

Since you're using pre-tax money in an HSA or FSA to pay medical bills, it would ultimately be up to the tax man to decide which expenses are legitimate.

"One cannot use the cost of marijuana because it is not legal under federal law," says Dean Patterson of the IRS. He points to the IRS manual on acceptable medical and dental deductions . On page 15 it reads, "You cannot include in medical expenses amounts you pay for controlled substances (such as marijuana, laetrile, etc.), in violation of federal law."

What about in states where it is legal? "No," is the answer from the American Fidelity Health Services Administration.

"It's not a prescription," says Pat Kusiak, assistant chief counsel at the California Franchise Tax Board. Kusiak cited the state's medical marijuana law , and, in fact, the word "prescription" is not used anywhere. Instead, doctors can give a "recommendation." "That's not legally equivalent," he tells me.

So if it doesn't qualify as a prescription, can you pay for medical pot like you can for other non-prescription items like aspirin, at least in states where it's legal?

It would probably depend on whether your HSA or FSA administrator would allow it.

Janice Kyser at WellPoint tells us her firm won't accept it. "Medical marijuana is not FDA approved and is therefore a coverage exclusion for most, if not all, member contracts including HSA/HRA."

Pat Kusiak at the state tax board says this shouldn't be considered unusual. Take aspirin versus diet supplements. "Aspirin would be covered, diet supplements would not."

Questions? Comments? Funny Stories? Email funnybusiness@cnbc.com