"We wanted to keep the story alive because Congress hasn't made the changes necessary to protect the average American investors," said Tim Murray.

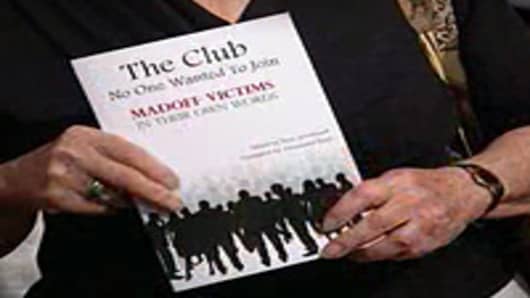

Murray is one of twenty nine Madoff victims who share their story in a new book titled "The Club No One Wanted to Join - Madoff Victims in Their Own Words (Massachusetts School of Law Press).

Murray joined a number of other victims who gathered outside Madoff's former offices in the Lipstick Building on New York City's Third Avenue today to promote the book.

"So part of the reason for writing this book is to tell the American people we look like everybody else, we're nobody, we're anybody, we are you and frankly this could easily happen to you," said Madoff victim Michael Devita. "You're not protected."

The victims who spoke with CNBC expressed their frustration with the Securities Exchange Commission (SEC), which failed to detect the fraud despite numerous warnings.

They are also angry with the Securities Investor Protection Corporation (SIPC), a government backed agency set up to provide up to $500,000 per account for investors of failed brokerage funds, and SIPC trustee Irving Picard. They allege both have been slow to help many victims who found themselves penniless.

Charged with distributing recovered Madoff funds to the victims, as of June 25th, Picard had received 13,041 claims on Madoff accounts and has denied more than 10,000 of those claims. The 2,145 claims allowed by Picard seek the return of $5.5 billion dollars. So far SIPC's covered $702.8 million of those claims or about 7.5% of the total allowed claims.

A March 31, 2010 report shows Picard has filed fourteen suits seeking to recover $14.8 billion from various feeder funds that funneled money from Madoff, Madoff family members and other parties. So far, Picard's efforts have netted $1.5 billion in funds to be distributed to the victims.

Still, some like Murray have not received any money in the last 18 months, and Murray says that the greatest frustration he's felt has come with working with Picard who told him a year after he filed his claim, he was denied SIPC insurance.

Picard declined comment for this story.

Along with SIPC and the SEC, DeVita claims state and the federal government have been dragging their feet returning taxes paid by victims on false profits.

"We are attempting to recover taxes paid on that from both the state and local governments. Both of those institutions have collected taxes for decades that were collected as a result of a crime," DeVita said. "Its almost impossible to perform any kind of restitutions based on those falsified 1099s."

The IRSdeclined comment on individual Madoff cases and did not respond to questions asking how much, if any money, it's returned to Madoff victims.

The investigation into the history's biggest Ponzi scheme continues more than a year and a half after Madoff confessed to the crime in New York City. Recently, federal prosecutors in New York City filed civil lawsuits against two Madoff aides Annette Bongiorno and JoAnn Crupi.

The suits allege both women "knowingly perpetuated" the decades long scheme and seeks to recover a combined $5 million in assets from them.

Madoff's former CFO Frank DiPascali was recently released on bail, pending his sentencing. Considered Madoff's right hand man, DiPascali's been in custody since August of 2009 after pleading guilty to ten counts including securities fraud and money laundering.