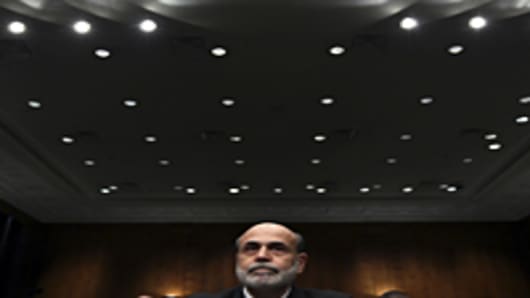

Fed Chairman Ben Bernanke went before Congress last week looking to emphasize the "unusual uncertainty" surrounding the US economy and wound up pledging, in no uncertain terms, that the Fed was prepared to take unusual steps to fire up growth.

"We are ready and will act if the economy does not continue to improve, if we don't see the kind of improvements in the labor market that we are hoping for and expecting," Bernanke told the House Financial Services Committeelast Thursday, following a similar briefing to a key Senate panel Wednesday.

Willing, yes, say economists; able, probably not.

"I think he's trying to mollify people. It's not a question of whether you have bullets but that people think he has bullets," says FAO Economics Chief Economist Robert Brusca, referring to a famous scene in the Clint Eastwood cop drama, 'Dirty Harry.' "I'm somewhat skeptical. I don’t think the bullets the Fed has left are very high-caliber ones."

Especially, when it comes to stimulating job creation, which, in an election year, may be a more important economic yardstick to Washington than Wall Street.

"He was simply playing to the audience," adds veteran Fed watcher David Jones of DMJ Advisors. "It might have been OK to do these unconventional things when we were in a panic and the conditions were unstable and unpredictable. It's another thing to do it when rates are already at historic lows. You're not going to get much positive effect."

After almost three years of fighting a one-of-a-kind credit crunch and a conventional, yet nasty, recession, the Fed Chairman looks to have delivered the most explicit example to date of the Bernanke Put.

Both supporters—like Brusca and Jones—and critics say Bernanke is on the verge of hurting the central bank's credibility, especially at a time when there's little consensus among its board of governors and regional bank presidents.

"The simple fact is that the Fed saved us, pulled us back from the abyss and so therefore the markets are poised to count on the Fed to bail them out again instantly—that's just not realistic," complains Jones. "It would hurt Fed credibility."

Credibility is a precious commodity for central bank and the Bernanke Fed has managed to retain enough of it despite a rocky denomination process for the chairman and aregulatory reform movement that tried to dilute or strip some of its powers.

Though that may not have hurt Bernanke's reputation and credibility on the outside—he generally receives high marks for his handling of the crisis, even if the Fed has been blamed for helping to cause it—it has arguably embolden people on the inside.

Both policy hawks and doves have questioned Bernanke's so-called exit policy from its easy-money, crisis posture.

"There are people in the Fed, who say the Fed has done enough, by engineering a turnaround," says Ram Bhagavatula, managing director at the hedge fund, Combinatorics Capital. "Month-to month volatility is a fact of life; recoveries come in fits and starts. These are problems [the Fed] cannot solve directly. You have no control over the timelines."

Under Congressional grilling, Bernanke trotted out the usual suspects the Fed considers options and tools, from lowering interest rates to zero, to more purchases of government debt to nudging banks into lending by making it less attractive for them to build and maintain large cash reserves.

Most of those yield yawns or skepticism in many quarters, despite growing impatience with the pace on the recovery on Wall Street and Capitol Hill, where legislators appear bereft of new options.

"You have a lot of Congressmen who would be really glad to have the Fed do the work for them," adds Brusca.

Whatever that may be.

"I don’t think its about Bernanke and the Fed; the Fed has done more than enough," says Allan H. Meltzer, a Fed historian, former White House economist and professor at Carnegie Mellon University's Tepper School of Business, who testified to Congress on the same day as Bernanke last week.

"There's a lot that can be done and much of it doesn't require new spending," adds Meltzer. "Much of it is reducing uncertainty, which is massive."