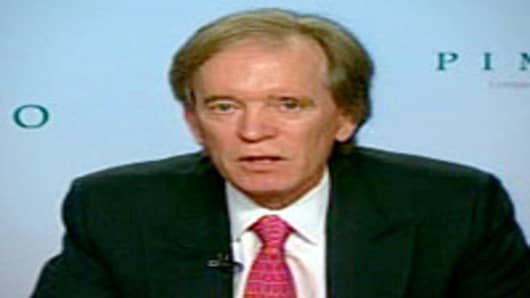

Bill Gross, a managing director at bond giant PIMCO, told CNBC Tuesday that if Fannie Mae and Freddie Mac lowered interest rates for mortgage holders in good standing, it would stimulate the economy, encourage consumer spending, promote job growth and give the beleaguered housing market a much-needed lift.

The federal government, through Fannie and Freddie , guarantees about 95 percent of the mortgages in the US.