Fund manager Jeremy Grantham, long a Federal Reserve critic, issued a blistering attack on Fed policies Wednesday, likening its strategy of low interest rates and monetary easing to a Halloween horror movie that is dangerous and destabilizing to the economy.

"In almost every respect, adhering to a policy of low rates, employing quantitative easing, deliberately stimulating asset prices, ignoring the consequences of bubbles breaking, and displaying a complete refusal to learn from experience has left Fed policy as a large net negative to the production of a healthy, stable economy with strong employment," said Grantham, chief investment officer of GMO, an investment management firm in Boston.

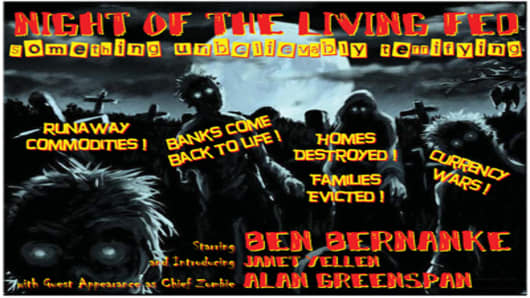

Grantham's quarterly note to clients came with a mock horror movie image titled, "Night of the Living Fed: Something Unbelievably Terrifying."Click here to read the note.

The comments by Grantham, a well-respected voice in the financial community, contributed to the selloff in stocks on Wednesday.

Stocks extended their losses as concerns grew that the Fed's next round of quantitative easing may actually be less aggressive than expected.

The central bank, which has already bought about $1.7 trillion worth of Treasury and mortgage-related debt, is expected to launch a second round of asset purchases next week of anywhere from $500 billion to $2 trillion. But the Wall Street Journal reported Wednesdaythat the central bank may start by buying only a few hundred billion dollars over several months.

Grantham, meanwhile, said the Fed's policies under both Alan Greenspan and Ben Bernanke have led to runaway commodity prices, asset bubbles, a falling dollar and are likely to have no long-term benefit for the economy.

The investment manager said if he were a "benevolent dictator," he would "strip the Fed of its obligation to worry about the economy and ask it to limit its meddling to attempting to manage inflation."

The problem with quantitative easing—the Fed policy of stimulating the economy through actions such as purchases of long-term debt—is it has historically led to the creation of more debt in the economy, as well as higher asset prices, and has not led to higher rates of GDP growth, Grantham said

Instead, lower rates “encourage speculation in markets and produce higher-priced and therefore less rewarding investments, which tilt markets toward the speculative end,” Grantham wrote. “Sustained higher prices mislead consumers and budgets alike.”

Grantham's attacks were not centered just on the current administration.

"In my opinion, capitalism has been manipulated far more, and more dangerously, by the last two Republican-appointed Fed bosses than everything else added together," he wrote. "It is naïve, if fashionable, to blame the rather lame current Administration for all of our problems. They inherited a cake already baked or, better, “half baked,” and the master bakers were the current and former Fed bosses, and the underbaker (not quite an undertaker, but nearly) was Hank Paulson with his “contained” sub-prime crisis."