Yet it's interesting that Amazon's stock isn't higher, noted Drakon Capital's Guy Adami. He thinks the stock has some longer-term prospects, though. But a week ago, countered Stuart Frankel's Steve Grasso, the stock was at $167.

"Guys are selling what's worked and they're getting back into that risk trade," Grasso said.

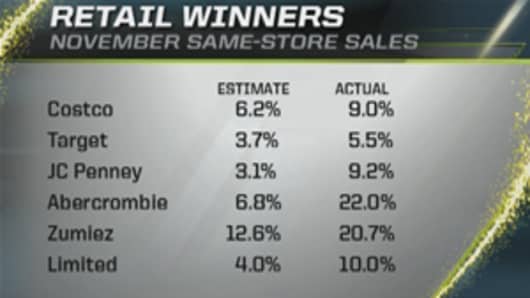

Meanwhile, with shares of Abercrombie & Fitch surging, Adami has to think the shorts are getting squeezed. After all, there's a 15 percent short interest in that stock, he said. Grasso added that the private equity takeout value was at $60, but after Thursday's action, he thinks that could go up.

Watch the video to see the complete conversation, which begins at 1:09.

---

LAS VEGAS SANDS DROPS NEARLY 5% MIDDAY

Despite strong gambling revenues out of Macau, shares of Las Vegas Sands fell sharply in trading Thursday.

Cortes recommends being cautious with this stock . He's shorting LVS at $50 because of the trade in China, noting that while its recently outperformed the Shanghai Composite, he doesn't think it's sustainable.

Najarian, on the hand, said he still likes the name, but didn't say why.

---

EAR TO THE WALL: ALCOA

After a German newspaper reported Rio Tinto may be interested in aluminum giant Alcoa, shares of AA surger higher Thursday.

This stock is interesting on valuation, said Adami. If the market pushes higher, he thinks the stock could push up to the 16 handle. In other words, shares of Alcoa could reach $16 and change on a good tape.

---

CALL THE CLOSE

"Time to sell retailers," reiterated Cortes.

Najarian said he still likes the upside from here. He expects theFinancialexchange-traded fund to lead the markets into the close.

Both Adami and Grasso think the markets could push lower, but said if the S&P 500 crosses the 1,228 level, it could go higher.

______________________________________________________

Got something to to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap. If you'd prefer to make a comment, but not have it published on our Web site, send those e-mails to fastmoney@cnbc.com.

Trader disclosure: On December 2, 2010, following stocks and commodities mentioned or intended to be mentioned on CNBC’s "Fast Money" were owned by the "Fast Money" traders; Cortes is short (XRT); Cortes is long S&P 500; Cortes is short (LVS); Cortes is long (TSN); Cortes is long USD vs. Mexican Peso, Australian Dollar, Euro; Cortes is long U.S. 2-year Treasuries; Grasso owns (ASTM), (BA), (BAC), (BWC), (C), (CSCO), (JPM), (LIT), (LPX), (MOT), (MHY), (NDAQ), (PFE), (PRST), (X); Jon Najarian owns (AAPL), Is Short (AAPL) Calls; Jon Najarian owns (GS), Is Short (GS) Calls; Jon Najarian owns (JPM), Is Short (JPM) Calls; Jon Najarian owns (CME), Is Short (CME) Calls; Jon Najarian owns (TIF), Is Short (TIF) Calls; Jon Najarian owns (RIMM), Is Short (RIMM) Calls; Jon Najarian is long (AMZN) call spreads; Jon Najarian is long (IBM) call spreads; Jon Najarian is long (NFLX) call spreads; Jon Najarian is long (DE) call spreads; Jon Najarian is long (GT) calls; Jon Najarian is long (AA) calls; Jon Najarian is long (CMC) calls; Jon Najarian is long (C) and (XLF) calls; Adami owns (AGU), (BTU), (NUE), (C), (GS), (INTC), (MSFT); Adami’s wife works at Merck

For Steve Grasso:

Stuart Frankel & Co and it’s partners own (AAPL)

Stuart Frankel & Co and it’s partners own (CSCO)

Stuart Frankel & Co and it’s partners own (CUBA)

Stuart Frankel & Co and it’s partners own (GERN)

Stuart Frankel & Co and it’s partners own (HSPO)

Stuart Frankel & Co and it’s partners own (NWS.A)

Stuart Frankel & Co and it’s partners own (NYX)

Stuart Frankel & Co and it’s partners own (PDE)

Stuart Frankel & Co and it’s partners own (PFE)

Stuart Frankel & Co and it’s partners own (PRST)

Stuart Frankel & Co and it’s partners own (RDC)

Stuart Frankel & Co and it’s partners own (TLM)

Stuart Frankel & Co and it’s partners own (XRX)

Stuart Frankel & Co and it’s partners own (SDS)

Stuart Frankel & Co And Its Partners Own (UNM)

Stuart Frankel & Co and it’s partners are short (QQQQ)

Stuart Frankel & Co and it’s partners are short (MCD)

Stuart Frankel & Co and it’s partners are short (AAPL)

Deborah Weinswig

An employee of Citigroup Global Markets or its affiliates is a trustee of Target Corp

Citi employees own (JCP), (WMT)

Citigroup Global Markets or affiliates owns 1% or more of (SKS)

Citigroup Global Markets or affiliates has managed or co-managed an offering of (HD), (TGT), (WMT) within past 12 months

Citigroup Global Msrkets or affiliates has received investment banking compensation in past 12 months from (HD), (KR), (SKS), (TGT), (WMT)

Citigroup Global Msrkets or affiliates expects to receive/seek investment banking compensation from (KR), (WMT) in next three months

Citigroup Global Msrkets or affiliate received non-investment banking compensation in past 12 months from (HD), (JCP), (KSS), (KR), (M), (SWY), (SVU), (TGT), (WAG), (WMT), (COST)

(HD), (KR), (SKS), (TGT), (WMT), are or in past 12 months were investment banking clients of Citigroup Global Markets

(CVS), (HD), (JCP), (KSS), (KR), (M), (SWY), (SKS), (SVU), (TGT), (WAG), (WMT), (COST) are or in past 12 months were non-investment banking clients of Citigroup Global Markets (securities-related services)

(HD), (JCP), (KSS), (KR),(M), (SWY), (SVU), (TGT), (WAG), (WMT), (COST) are or in past 12 months were non-investment banking clients of Citigroup Global Markets (non-securities related services)

Citigroup Global Markets is a market maker in (CVS), (M), (COST)

Citigroup Global Markets and/or affiliates has a signifcant finacnial interest in relation to (HD), (KSS), (KR), (LOW), (M), (JWN), (SWY), (SKS), (SVU), (TGT), (WMT), (COST)

Citigroup Global Markets or affiilates owns 5% or more of (SKS)

CNBC.com with wires.