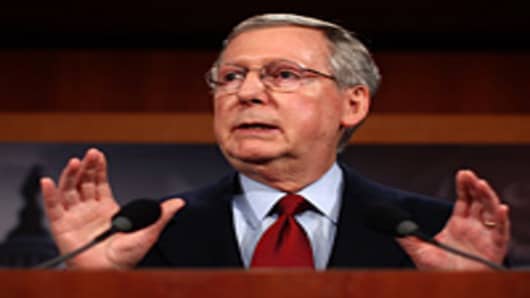

After thwarting efforts to raise taxes on America’s top earners, Sen.Mitch McConnell, the Republican leader, predicted Sunday that Congress would retain the expiring Bush-era tax cuts for a limited number of years and might also extend unemployment benefits as part of a compromise with the White House.

In recent weeks, as the blocking power of the Republican minority overwhelmed a Senate majority, the White House and Congress had been discussing a deal to extend the reduced Bush tax rates for all income levels, not just for those below $250,000, for a short period, perhaps two years. News reports have indicated that as part of such a deal President Obama, who wanted to raise the rates for incomes above the $250,000 threshold, would insist on an extension of unemployment insurance for jobless Americans whose benefits are running out.

Mr. McConnell, interviewed on the NBC television program “Meet the Press,” flatly confirmed the outlines of that compromise. “I think we will extend unemployment compensation,” he said. The debate among lawmakers, he said, is “not about whether to do it but whether to pay for it as opposed to adding it to the deficit.”

He would prefer to make the tax cuts permanent because the current, 10-year-old tax rate “is appropriate,” he said. But “the president won’t sign a permanent extension.”

“I’m very hopeful that the tax rates won’t go up,” he added, signaling his belief that the White House has abandoned its efforts to raise taxes.

Mr. McConnell also said he had not made up his mind about whether he would support a new nuclear arms treaty with Russia in the remainder of this congressional session, an apparent confirmation that Republican support for ratification may also be part of the multifaceted discussions with the White House. Mr. McConnell’s statement appeared more flexible than some made by Senator Jon Kyl of Arizona, who has been the Republican point man on the treaty and said last month that there was not enough time to consider renewing the pact in the lame-duck session of Congress.

On Saturday, the Democrats failed to muster the 60 votes that could have stymied a Republican filibuster, thereby effectively losing two Senate floor votes on the tax cuts — one to let tax rates rise for couples making over $250,000 and individuals making $200,000 and another to end the tax breaks on incomes exceeding $1 million.

Thus the focus in Washington shifted to the behind-the-scenes negotiations between Republican and Democratic leaders and the Oval Office. In describing those talks, Mr. McConnell seemed unusually magnanimous about relations with the White House, a result of the cards he was handed by the November elections, in which Republicans took back the House and trimmed the Democratic majority in the Senate.

“We’ve had more conversations in the past two weeks than we’ve had in the past two years,” he said about the White House, with a smile. “There’s a growing awareness that the power will be more symmetrical in the next Congress.”

With the Senate’s weekend votes now recorded, “it’s pretty clear that taxes are not going up on anybody in the middle of a recession,” the senator said, adding, “We’re discussing how long we should extend the tax rates.”

Mr. McConnell said raising taxes would hurt the nation’s 700,000 small businesses, which generate jobs. Democrats have argued that there is little evidence that individual income over $1 million is invested in job creation.

Interviewed on the same program, a combative Senator John Kerry of Massachusetts, the Democratic presidential candidate in 2004 and the chairman of the Senate Foreign Relations Committee, said the Republican position on tax cuts “would put money in the pockets of people who may never invest it in the United States.”

To retain those tax cuts for the wealthy, he said, the Republicans were “willing to hold unemployment compensation hostage.”