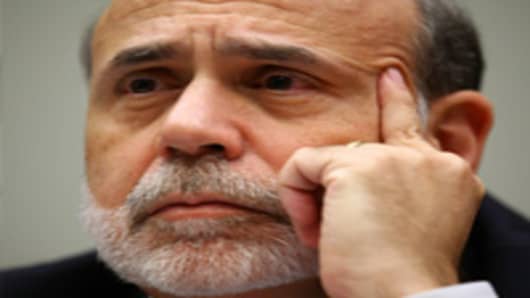

Fed Chairman Ben Bernanke appears before the House Budget Committee Wednesday, in what promises to be one of the two most widely watched events of the trading day.

The other event is also a hearing on Capitol Hill, where Bernanke, himself, and the Fed are under fire in a session called by Fed critic Rep. Ron Paul, R-Texas, who heads the House Financial Services' Domestic Monetary Policy and Technology Subcommittee. The focus is on the impact of the Fed's policies on unemployment and job creation, but no Fed officials are scheduled to speak. Both hearings start at 10 a.m.

Yet, market expectations are low for fresh news from Bernanke's testimony, even though the Budget Committee hearing casts him in the center of what promises to be one of the hottest and most important political debates for Congress, as the U.S. emerges from the financial crisis. A divided Congress will have to tackle how the U.S. manages its huge deficits and gets its financial house in order.

Paul's committee will hear testimony from Thomas DiLorenzo, a professor from Loyola University Maryland, and Richard Vedder, a professor form Ohio University.

"Paul thinks the Fed should be disbanded so he's going to say a lot of exciting stuff," said Lord Abbett senior economic strategist Milton Ezrati.

Bernanke, no doubt, will be asked about the Fed's policies at the Budget committee hearing, but market participants think Bernanke probably said as much as he intends to say at an appearance in Washington last week. He is also expected to stick to the Fed's recent meeting statement.

Bernanke also appears at a time when the market is once more questioning the wisdom of the Fed's easing program. Richmond Fed President Jeffrey Lacker Tuesday said the Fed should be willing to cut back its $600 billion in Treasury purchases if employment improves and consumer spending holds up. Lacker said he was not ready to stop it yet, but his comments fell on markets that have been pricing in an improving economic picture and leery of potential inflation.

Last week, Bernanke stepped into the political fray with a warning to Congress not to use the debt ceiling limit as a "bargaining chip " in their debates over spending and taxes. The U.S. may breach the $14.3 trillion debt ceiling limit in early April if it is not raised.

In addition to Bernanke, the Fed's Brian Sack speaks at an event at the Philadelphia Fed at 5:45 p.m. ET. Sack is executive vice president of the Markets Group at the New York Fed and is expected to discuss the Fed's asset purchase program. The asset purchase program is scheduled to expire by the end of the second quarter, and economists, for the most part, do not anticipate the Fed will start raising rates until sometime next year or even later.

"I think Bernanke is the less interesting of the two," said David Ader, chief Treasury strategist at CRT Capital. "Sack is the more interesting. He's in charge of QE2 (quantitative easing.)"

"He may start to outline more ideas on the exit strategy. I suspect he will say hikes before asset sales," said Ader.

Ader, and others are also watching the 1 p.m. auction of $24 billion in 10-year notes. The 10-year yield rose to 3.73 Tuesday, from 3.64 percent Monday. The 30-year moved to 4.70 percent, and the 5-year rose to 2.40 percent from 2.27 percent Tuesday.

"The curve is moving parallel. It's not like the curve is steepening. Everything is moving. We're moving to a higher interest rate paradigm. it's not a real inflation scare or a Fed hike scare," Ader said.

The 10-year broke out of its recent range late last week. "I think we're going to see something north of 3.75, maybe 3.90 or 4, but it's not going to happen immediately. I think we'll rally 10 bps, back up 15. I think it's going to be a sort of grudging move higher. We've got QE2 ending in June and I think the market has to adjust to the idea that this big massive buyer is gone and I think we'll be grinding higher towards that event," Ader said.

Stocks moved higher Tuesday, even as China's latest rate hike held back global equities markets initially. The Dow was up 71 at 12,233, and theS&P 500rose 5 to 1324. The dollar was weaker against the euro, at 1.3633.

Oil lost $0.54 per barrel, to $86.94 per barrel. After the close, API reported crude inventories fell by 558,000 barrels, while analysts expected an increase of 2.4 million barrels.

Gold gained $15.80 an ounce, to $1363.40, as China's rate move stirred concerns about inflation.

Questions? Comments? Email us at marketinsider@cnbc.com