If there's a race to capitalize on rare earths—both in the short and long term—Molycorp is extending its early lead.

On Monday, the Colorado-based company announced an $89 million deal to buy a controlling stake on AS Simet, one of only two rare earth processing facilities in Europe.

The dollar amount of the deal is small, but the impact is not.

Molycorp is currently working on a new processing facility that won't be fully operational until late 2012. When it's up and running, its Mountain Pass, California facility will mine and process rare earths for market.

Currently, beyond the construction and preparation for 2012, Molycorp is processing rare earths from old leftover stockpiles at the mine.

Now, the company can better capitalize on the current price spikes, gain a footprint in Europe and further improve strength in the sector.

"We have already begun shipping feed stocks from Mountain Pass to be processed into finished products at AS Molycorp Silmet," President and CEO Mark Smith said in a statement. "In the short-term, this will greatly increase our ability to supply our products into the increasingly tight global rare earth market and provide a convenient base from which to supply European customers."

And it should provide a further boost to the stock price.

"The deal should be immediately accretive to earnings and will allow the company to capitalize on the recent strength in rare earth element pricing," said Anthony Young, who covers the companY for Dahlman Rose. "Given that the deal should be immediately accretive, we would view the acquisition as a positive for the shares."

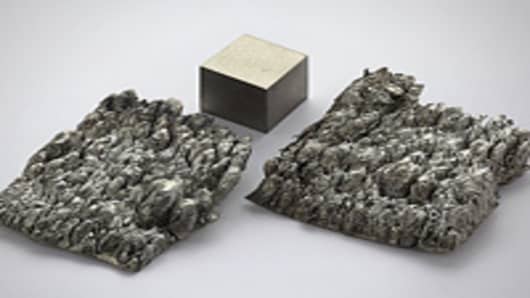

Right now, China controls about 97 percent of the global market, yet has been steadily reducing its exports. Since the technology sector relies heavily on these difficult-to-mine elements, there's been a global rush to find ways to both make up for the scarcity and take advantage of incredible price gains.

Outside of China, Molycorp and Lynas are considered the two most viable options. Neither is ready for full production, but Molycorp's acquisition of the Estonia-based Silmet seems to be worth the price.

"While less important to long-term earnings power, it will allow the company to diversify its sales footprint into Europe and forge closer relationships with customers in this region," Young said.