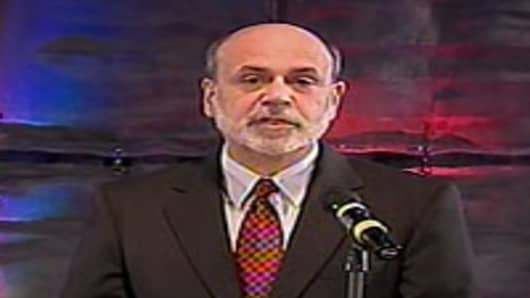

The Federal Open Market Committee meets later this week and Fed Chairman Ben Bernanke will have to communicate his view on the recent slowdown in the US economy when he faces his second-ever post decision press conference.

The speed with which the US economy has slowed took many by surprise over the last four-six weeks but investors should not expect the Fed chairman to signal he is ready to pump more money into the system, according to Wall Street bosses and analysts.

The end of the second round of quantitative easing - as the Fed calls its program of buying assets from the markets - has been well flagged by the central bank and two of Wall Streets leading CEOs told CNBC that the market should not see it as a surprise.

“The Fed basically told you they were going to do that quite a long time ago,” Steve Schwarzman, the CEO of Blackstone , told CNBC in an interview from St Petersburg.

“I always find it fascinating that when things start happening, people start reacting as if they were never told it was going to happen," Schwarzman added. "I sort of look at QE2 as something that is more or less in people's expectations, and we're not positioning ourselves for some short-term operation of that type.”

The boss of Bank of Americaagrees with Schwarzman. “I think the market understands. I think Chairman Bernanke has been very clear about his priorities of movement. So I don't think there's much mystery left in it,” Brian Moynihan, the CEO of Bank of America told CNBC.

Rates Low 'for a Long Time'

The bank's prediction is that the interest rate will stay low "for a long time" because the US unemployment has to move "in a direction that is such that you know it's going to go in the right direction," he added.

“We're such a huge economy that we’ve got to make sure this economy stays moving the right direction. So it still grows. Everything we see still sees that growth. I think our view is that rates stay pretty low for a long time because this is a big economy, and it's going to continue to crawl forward,” Moynihan also said.

The signs of the renewed economic slowdown should not prompt "a knee-jerk reaction" from the Fed, Paul Dales, the senior US economist at Capital Economics wrote in a research note.

“The accompanying statement is bound to acknowledge the evident loss of momentum, as should Fed Chairman Ben Bernanke in his second ever post-meeting press conference,” Dales added.

But this will not, in Dales's view, lead to Bernanke indicating he is considering another round of quantitative easing.

Given that the slowdown could be due to temporary factors, that the imminent threat of deflation has eased and taking into account the mixed results of QE2, we see little prospect of QE3, at least not this year,” he wrote.