With QE2 officially ending on Thursday, many investors aren’t quite sure where to put money to work. If you're among them, Doug Kass of Seabreeze has some ideas.

As you might expect Kass, a CNBC Contributor, is not among the growing chorus of investors who think a wave of optimism is about to sweep across the market. “The positive news out of the US economy is so small you need a microscope to see it,” he says with a grin in his voice.

But Kass does see opportunity.

As Kass has told the Fast gang so many times before, he expects the S&P to bounce between 1250 – 1350 through year’s end. In that kind of environment, there’s only one thing do to. “Don’t be super bullish or bearish – be a stock picker!” Kass says.

Now, what you might not expect is that of all places to go stock picking – Kass thinks one of the best places to go is the financials. (Yes the financials.)

But don’t go running out and buying the big banks just yet – Kass is focused on a niche area of the sector – specifically the life insurance names.

Largely his thesis is quite simple – he thinks life insurance stocks will soak up money from investors who need to put money to work somewhere -- anywhere -- in the financials services space.

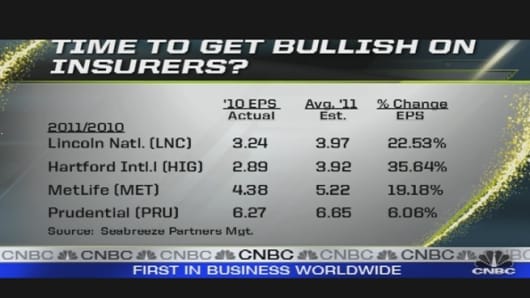

And Kass is particularly keen of 4 stocks. Lincoln National, Hartford International , MetLife and Prudential.

In a nutshell he thinks these stocks are a bargain. “Look at how these valuations are so cheap," he says referring to the chart to your left.

"They’re trading at under 7 times next year’s earnings. And at ¾ of book value”

He goes on to say, ”These are ratios and discounts to book value which are both over 1 standard deviation below their average.”

And Kass thinks there are plenty of catalyst to help drive shares. “I think ROE for the industry will be at least 11% next year.”

"Also, Goldman analyzed mutual fund weightings in life insurance and found the life insurers are underweighted by nearly 40% relative to the S&P."

On top of that he says “credit spreads are narrowing and short interest has expanded. And I see share buy backs.”

______________________________________________________

Got something to to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap. If you'd prefer to make a comment, but not have it published on our Web site, send those e-mails to fastmoney@cnbc.com.

CNBC.com with wires.