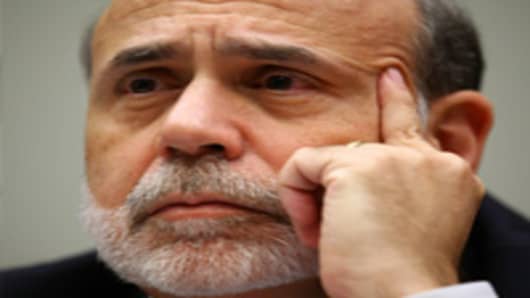

For those of you worried that the scheduled expiration of higher loan limits at Fannie Mae, Freddie Mac and the FHA will have a negative effect on the housing market by raising the cost of home ownership, you can be rest assured the chairman of the Federal Reserve is fine with it.

"As far as Fannie Mae and Freddie Mac are concerned, there is a tradeoff there between supporting the higher priced homes and weaning the housing finance system off of unusual limits it was put under during the crisis," Ben Bernanke told a Congressional Committee today.

"I understand the private sector is taking at least a significant number of the jumbo mortgage market but at a higher cost," Bernanke said.

There have been numerous and varied contentions about the future state of the mortgage market once loan limits drop from the maximum $729,750 to $625,500. The home builders think it will be catastrophic while some economists and academics say it will have little effect, especially at the FHA.

Bernanke admits that jumbo loans will come, "at a higher cost," but we have to put in perspective what exactly that higher cost will be. Mortgage rates on conforming loans are already near historic lows, hovering around 4.5 percent on the 30-year fixed. Today's talk about the potential for QE3 pushed bond yields lower, which in turn keep mortgage rates low.

"I think as long as the 10 yr [Treasury] remains in the 2.85-3.15 percent range, the average 30-year mortgage rate will continue to hover around the 4.5-4.6 percent range," says Peter Boockvar at Miller Tabak. "Bonds are little changed on the day but off the lows after the auction."

The bond market doesn't seem to think the U.S. is really in danger of defaulting on its obligations, so rates should remain steady. If a jumbo rate is higher, even by a full percentage point, it's still historically pretty low, and buyers looking at a higher-priced home likely expect to pay a higher interest rate already anyway.

Rather than worry about conforming loan limits, I think we need to be more concerned about proposed rules surrounding mortgage risk retention by banks and what constitutes a qualified residential mortgage (QRM) which would be exempt from risk retention. Bernanke seems to think 20 percent down for a QRM is the right course. The mortgage industry, largely, does not.

Questions? Comments? RealtyCheck@cnbc.comAnd follow me on Twitter @Diana_Olick