Until Washington resolves its debt ceiling impasse no investments are safe and investors should shed all positions in the stock market, banking analyst Dick Bove said Wednesday.

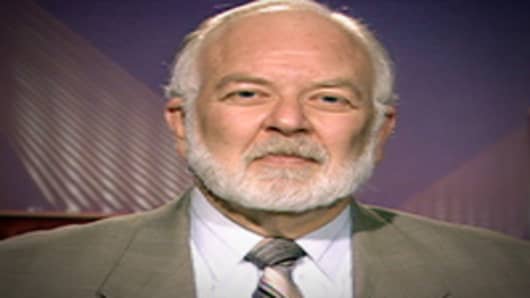

Bove, the Rochdale Securities analyst who has launched a series of stinging criticisms over the inability of Congress to get a deal done, writes in a note to clients that the increasing likelihood of no deal will have severe repercussions.

As such, he says, there is no safe-haven investment at the moment.

"It now makes sense to test the unthinkable," he writes. "Thus, for the moment I would suggest suspending investing since all stocks are likely to fall."

Bove, who was on CNBC Wednesday night, told the network earlier this week that if the debt impasse pushes up borrowing costs, the ripple effects will be severe—especially housing and banks.

Republicans and Democrats are battling over what conditions should be attached to raising the $14.29 trillion debt ceiling. The battle is between a longer-term deal that the Democrats seek against a shorter-term solution proposed by some Republicans.

Those interests have come up against those on the far left who want tax increases attached to the agreement, while Tea Party Republicans want greater spending cuts.

Bove says the tug-of-war will cause investors to lose.

Foreigners are trying to "disassociate" their holdings from the U.S., a lesson made clear to him during an interview he did on China Radio Tuesday night.

"Investors worldwide may actually be horrified that the only safe haven at the minute is short-term Treasurys and bank deposits backed by the FDIC," he says. "The contradictions here are enormous."

Bove calls for a new "safe haven" for investors as both stocks and bonds sell off.

He rejects gold because it "is too illiquid and there is not enough of it," quickly rising Swiss francs because the government will "stop the inflows to that nation to protect its economy," the euro because Europe has the same problems as the U.S. and the dollar because the U.S. "can no longer be counted on to be fiscally or financially responsible."

"Many options are likely to be experimented with until the new global financial configuration is arrived at," Bove writes. "Investors must be attuned to how this new financial era will be shaped and invest accordingly. Right now, however, they must protect themselves by remaining liquid."

___________________________________________

Questions? Comments? Email us at NetNet@cnbc.com

Follow Jeff @ twitter.com/JeffCoxCNBCcom

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC