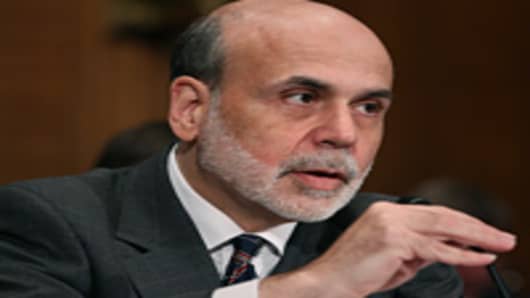

Federal Reserve Chairman Ben Bernanke's speech from Jackson Hole, Wyo., on Friday has already been more widely publicized than a James Cameron film—although you can expect fewer special effects.

As the day of the speech approached, analysts were united in believing that the chance of a headline-grabbing announcement of more quantitative easing from Bernanke was unlikely.

"Don't hold your breath therefore for what we might get from Wyoming," advised Simon Ballard, senior credit strategist at RBC Capital Markets.

Most analysts are agreed that Bernanke will talk about the Fed's grimmer outlook for the U.S. economy, and defend its actions to date.

Where they differ is in what they think he may actually announce on monetary policy, if anything, and what the effect will be on the markets.

Options range from a simple reiteration of what he's already said about the U.S. economy, to hints of a "twist light" or even a "twist heavy."

For those of you who think those sound like dance moves, the "twist light" involves lengthening the maturity of the Fed's portfolio. This is the most likely option of providing further easing, according to clients polled by Nomura.

Analysts atCiti wrote that "officials believe this aspect of their purchases affects the degree of stimulus and if it is financed not by money creation, but by diverting reinvestment out to 10 or 30 years it could provide support to financial conditions with possibly less adverse effects."

The "heavy" would involve selling short-term securities and buying longer-term securities, which "could hurt financial conditions more than help," according to Nomura.

No Fireworks

Analysts at Citi, RBC and Bank of America Merrill Lynch are among those who think the speech will not be providing fireworks.

"Sterilized or reserve-neutral purchases of longer duration securities may be viewed as the first, optimal choice," Citi analysts wrote in a note.

Goldman Sachs analysts, who expect further quantitative easing in some form, are predicting that Bernanke will deliver "an outline of easing options, focused primarily on changes in the Fed’s balance sheet."

This could contain "detailed discussion of the potential for more easing through large-scale asset purchases," they wrote earlier this week.

Economists at BofAML believe that Bernanke will "just review the available policy options" but caution that "the Fed is likely to begin lengthening its portfolio in the autumn, updating the 'operation twist' of the early '60s."

They point out that this might be difficult to sell to the Fed's hawks, and that it might have to go hand-in-hand with inflation-targeting to appease them.

If Bernanke were to announce further easing to replace the program that finished this summer, some believe that it wouldn't give markets the required long-term jolt.

"Any QE3 which is a de facto redux of QE2 will be a critical step towards a collapse in policymaker credibility amongst the markets and amongst the real economy," Bob Janjuah, analyst at Nomura, wrote earlier this week.

"QE3 wouldn't be a game-changer, in our view, just as QE1 and QE2 haven't been. If Mr Bernanke doesn't deliver, then we would expect risk asset pricing to adopt a more downbeat sentiment once again as we head into the weekend," said RBC's Ballard.

There are concerns about how much the market has priced in a third round of easing, and what the reaction will be in the U.S. market , and the currency markets if an announcement is perceived as negative.

The price of gold , one of the most spectacular gainers of recent months, could be affected.

"Some traders were taking profits ahead of Bernanke’s Jackson Hole speech on Friday, no longer so convinced that he will opt for QE3 just yet, which if true is certainly a negative for the shiny metal," wrote analysts at FXPro.