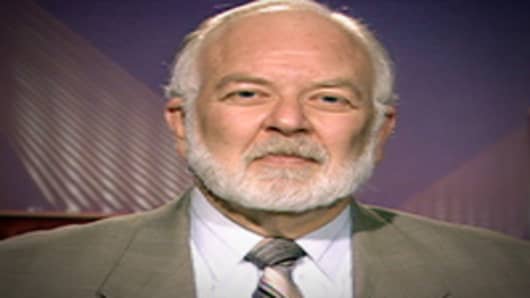

European banks susceptible to shocks from the debt crisis in Greece and other nations should get access to a program similar to what US banks had during the financial crisis, analyst Dick Bove told CNBC Tuesday.

With financial institutions in 2008 suffering hundreds of billions in writeoffs from bad loans, the Treasury Department instituted the Troubled Asset Relief Program, or TARP, to help the banks recapitalize.

While it wasn't enough to save some big banking names, the program is largely credited with staving off greater financial disaster when the housing market and subprime mortgage collapse caused a market crash.

Bove thinks a similar program would help Europe through its financial mess, caused by countries overburdened with debtthat they cannot pay back. He has called TARP one of the most successful government programs ever, detailing in a CNBC interview Tuesday how it averted disaster.

"The banks stop the run, they now start to write off their assets down to realistic levels and they start to build cash," he said. "So as a result of that the American banking system now has $1.6 trillion in cash sitting at the Federal Reserve, just sitting fallow. As a result this was the most successful program the US government has been in since it bought Alaska."

The problems with Greece and its neighbors involve severe debt burdens in countries where growth is slow, making it nearly impossible to meet bond payments. The crisis has driven fear that a default will trigger a domino effect that will spread through the continent and ultimately to the US.

Objections to TARP-like programs often center on the concept of moral hazard—the notion that providing such bailout devices only encourages the kind of behavior that created the crisis.

Bove said the success of TARP, though, has actually benefited the government and could achieve the same ends in Europe.

Some government agency or central bank can help coordinate the European arrangement, which would be made easier because the institutions already are bound by Basel capital requirements, Bove said.

US Treasury Secretary Timothy Geithner has called on action to address the European debt problem but said a coordinated effort akin to what happened in 2008 is unlikely.

"So we do have a mechanism in place to determine whether these banks are meeting what is required," Bove said. "The fact of the matter is I could care less whether Greece goes under or whether some other country goes under. What I'm interested in is whether the banks that hold that debt have marked it properly and have enough equity and liquidity to handle the hit."