The Federal Reserve announced Tuesday it plans to stress test U.S. banks—including the six largest—against a hypothetical market shock, such as an escalation of the European debt crisis.

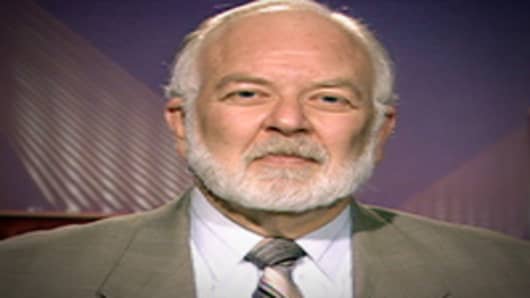

But noted banking analyst Dick Bove said there is nothing for investors to get upset about because the stress tests are pro forma and are not an indication that the Fed has any particular concerns about the state of American banks.

“It was really required by the Dodd-Frank law that they have a stress test,” the Rochdale Securities analyst told Larry Kudlow. “So every year at about this time you have the Fed setting up a new stress test for the banking industry.”

The six big banks to be tested are Bank of America , Citigroup , Goldman Sachs , JPMorgan Chase , Morgan Stanley and Wells Fargo .

While the Fed's stress tests will see whether U.S. banks can withstand any further deepening of the European debt crisis crisis, Bove isn't worried about contagion from the EU.

“If [the European banks] run into significant difficulties, it is not going to create a massive crisis in American banks,” he said. “American banks are benefiting meaningfully as a result of the European banking crisis and it’s showing up in their earnings.”

That’s because European banks are selling American assets to American banks at discounted prices.

However, Bove thinks it’s highly unlikely that the European banks will collapse. He believes the European Central Bankwill ultimately bail them out.

Questions? Comments, send your emails to: lkudlow@kudlow.com