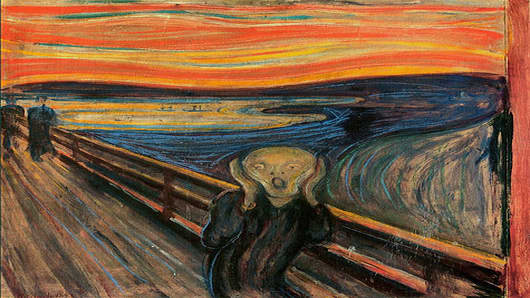

Had Wall Street bulls morphed into a painting on Tuesday, there’s no question that they would have become Edvard Munch’s The Scream.

By the close, you could all but see them, hands at their faces melting in a shrill cry of absolute frustration.

And who can blame them?

For the 5th consecutive day, the Dow and S&P 500 finished lower with the latest declines among the largest losses this year in terms of both points and percentage drops for each of the three major U.S. stock indexes.

In fact, Tuesday’s slide marked the S&P 500's worst day since Dec. 8th.

For bulls, there are plenty of reasons to scream.

Looking at fundamentals, concern is growing that Europe’s financial woes are far from resolved and that the US market may again find itself at the mercy of headlines.

“You have to ask yourself, are we back to the old stock market? One that is euro-centric,” says trader Steve Grasso. In other words, one that rises and falls in tandem with developments overseas.

The technicals are equally bearish. The S&P 500 dropped below its 50-day moving average of 1,372.30, an area that should have been support – but wasn’t.

"Dropping below that level suggests a loss of momentum, and it looks pretty widespread," says Katie Stockton of MKM Partners.

The Nasdaq also slid below its 50-day moving average and closed below 3,000 for the first time since March 12.

Trader Guy Adami says traders won’t really know how serious the sell-off is for another few weeks. “If S&P ends the month below 1340, we’re looking at an outside reversal month to the downside.” That's an extremely bearish signal.

Just like the outside reversal higher last October was a bullish sign, the reversal lower would be equally negative.

“That would suggest weakness will continue for an additional few months,” says Adami.

Although he's concerned about the elevated levels in the Vix, and the change of sentiment in the market Pete Najarian isn't nearly as bearish as Adami. "In the last 30 minutes, the Vix pulled back despite the fact that the market finished on the lows." That's a positive.

As a value investor trader Karen Finerman thinks the pullback presents opportunity - if you can buy and hold for the long-term.

“The sell-off seemed orderly to me,” she says. Nothing to be alarmed about, just a needed correction after a big run higher. “I did some buying,” she adds. “I bought a little Cummins ,and a little Microsoft and I have my eye on BofA . Sure they could go lower tomorrow but I’ll never be one to pick a bottom.”

______________________________________________________

Got something to to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap. If you'd prefer to make a comment but not have it published on our Web site send those e-mails to fastmoney@cnbc.com.

Trader disclosure: On April 10, 2012 , the following stocks and commodities mentioned or intended to be mentioned on CNBC’s "Fast Money" were owned by the "Fast Money" traders; Guy Adami is long C; Guy Adami is long GS; Guy Adami is long INTC; Guy Adami is long AGU; Guy Adami is long MSFT; Guy Adami is long NUE; Guy Adami is long BTU; Dan Nathan is long AAPL JAN 450 PUTS; Dan Nathan is long BAC MAY 7 PUTS; Dan Nathan is long JPM APR 42 PUTS; Dan Nathan is long XLF APR 15 PUTS; Dan Nathan is long YHOO APR 16/17 CALL SPREAD; Dan Nathan is long IBM APR 200 PUTS; Dan Nathan is long WMT APR 60 PUTS; Dan Nathan is long RIMM JAN 20 CALLS; Karen Finerman is long AAPL; Karen Finerman is short AAPL CALLS; Karen Finerman is long BAC; Karen Finerman is long WMT; Karen Finerman is long TGT; Karen Finerman is long RIMM CALLS; Karen Finerman is long BID; Karen Finerman is short SPY; Karen Finerman is short MDY; Karen Finerman is short IWM; Karen Finerman is short SPY; Pete Najarian is long AAPL ; Pete Najarian is long AAPL CALLS; Pete Najarian is long C; Pete Najarian is long JPM; Pete Najarian is long MS; Pete Najarian is long INTC; Pete Najarian is long YHOO; Pete Najarian is long SBUX; Pete Najarian is long COP; Pete Najarian is long PEP

For Asher Edelman

Nothing to disclose

For Brian Pitz

UBS AG, its affiliates or subsidiaries has acted as manager/co-manager in the underwriting or placement of securities of this company/entity or one of its affiliates within the past 12 months: GOOG

Within the past 12 months, UBS AG, its affiliates or subsidiaries has received compensation for investment banking services from GOOG

This company/entity is, or within the past 12 months has been, a client of UBS Securities LLC, and investment banking services are being, or have been, provided: GOOG

This company/entity is, or within the past 12 months has been, a client of UBS Securities LLC, and non-investment banking securities-related services are being, or have been, provided: GOOG

This company/entity is, or within the past 12 months has been, a client of UBS Securities LLC, and non-securities services are being, or have been, provided: GOOG

Within the past 12 months, UBS Securities LLC has received compensation for products and services other than investment banking services from this company/entity: GOOG

UBS Securities LLC makes a market in the securities and/or ADRs of this company: GOOG

A U.S. based global equity strategist, a member of his team, or one of their household members has a long common stock position in GOOG

For Sara Senatore

Accounts over which Bernstein and/or their affiliates exercise investment discretion own more than 1% of the outstanding common stock of the following companies SBUX

Accounts over which Bernstein and/or their affiliates exercise investment discretion own more than 1% of the outstanding common stock of the following companies DRI

Bernstein currently makes a market in the following companies SBUX

For Carter Worth

Nothing to disclose

CNBC.com and wires