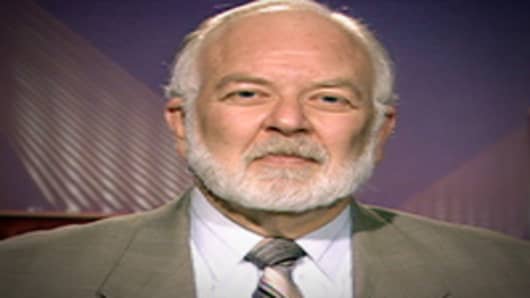

JPMorgan Chase is one of the best banks in the U.S., with some of the best managers in the industry, and one trading error will not change that, Richard Bove, vice president of equity research, financial sector, at Rochdale Securities, told CNBC’s“Worldwide Exchange.”

“There are only five companies in the United States that made more money than JPMorgan last year, so to assume that this staggeringly successful, profitable company might now be in trouble is a farce,” Bove said.

JPMorgan’s Chief Executive Jamie Dimon testifies before Congress later this year on the huge trading loss of at least $2 billion by the trader in the banks London office dubbed the “London Whale.” Many analysts suggest the bank is “too big to fail.”

The congressional Central Banking Committee meets later Tuesday to discuss Wall Street reform as part of a series of meetings which conclude on June 6, with the Financial Stability Oversight Council meeting to review the bank's transactions. Regulators are expected to use JPMorgan’s loss as an example to help shape regulations going forward, including the Volcker rule .

“The company will increase its dividend 20 percent this year, its earnings will be higher this year, and up 15 to 20 percent next year, so I think we’ve done the overselling by more than a little bit,” Bove said.

The bank canceled its share buyback program, but insisted that this was not linked to the loss.

“The fact that the company is not buying back stock does not hurt the ability of the company to make money, but enhances it. Stock buyback is a way to manipulate earnings per share, not a way to get more profit from a business you’re operating," Bove said.

He added that politicians wading into the bank’s loss were “totally absurd” and the U.S. needed big banks.