The Federal Reserve's latest quantitative easing promise has had little effect on the dollar. Here's what could change that.

Remember the buildup to QE3?

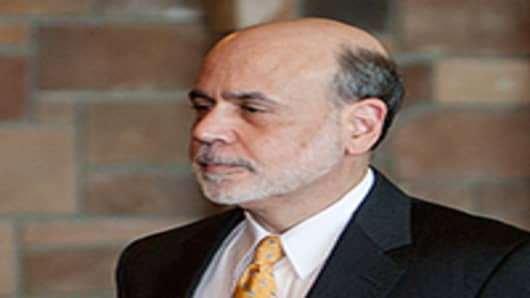

Investors were on the edge of their seats waiting to see if Fed Chairman Ben Bernanke would really pull the trigger. Now that he has made his move, it's worth stepping back to see what the effect has been on the dollar.

Not much.

"Since QE3 became a concrete reality in mid-August currencies have barely budged, and both US bond yields and the S&P are basically flat," says Steven Englander, global head of G10 FX strategy at Citigroup. "The only assets that enjoyed a pop are precious metals and even that pop is fading."

There are several reasons for the lackluster response, Englander wrote in a note to clients. Investors may be worried that an improving economy will remove the need for QE, and they are questioning the degree to which Fed officials can commit their successors to the policy. There is also the question of whether this is just an effort to lower rates now, and also, "will the Fed face basis drift because its policy rule is specified on imperfect measures of its final goals?"

In short, investors just don't quite believe in QE3, Englander says: "there is considerable uncertainty over whether such commitments are meant to be enforced, will be enforced and should be enforced by future FOMC's."

What could persuade investors to buy in? "The Fed will have to reiterate its views forcefully and provide something more tangible in order to get investors to act on the policy shift," Englander says.